NIIF and a subsidiary of ADIA signed First Investment Agreement

New Delhi, October 17: The first investment agreement of 1 billion USD between National Investment and Infrastructure Fund (NIIF) Master Fund and a subsidiary of Abu Dhabi Investment Authority (ADIA) has been signed on Monday. ADIA will become the first institutional investor in NIIF’s Master Fund and a shareholder in the NIIF’s investment management Company.

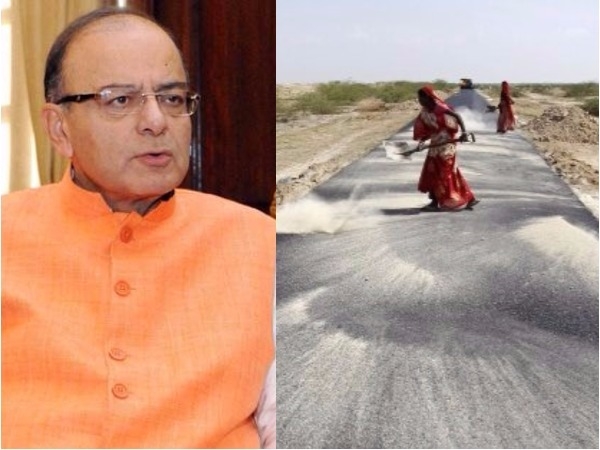

To mobilize long-term investment into NIIF, The Government of India and the Government of United Arab Emirates (UAE) in accordance with a law have signed Memorandum of Understanding (MoU).To act as an advisory council to NIIF, Governing Council has been set up under the chairmanship of the Union Finance Minister Arun Jaitley.

Talking about the development, Secretary Economic Affairs, Subhash Chandra Garg said that this is a significant milestone in the operationalization of NIIF. This Agreement paves the way for creating significant economic impact through investment in commercially viable infrastructure development projects.he further added that with ADIA joining NIIF, we had a very good first close. Government stake reduced to 49%. Professionals now take over investment decisions.

Under the SEBI Regulations, The NIIF was created by the Union Cabinet July 2015, forecasted as one or more Alternative Investment Funds (AIFs). Along with ADIA, Six domestic Institutional Investors (DIIs) will also be joining the NIIF Master Fund apart from Government of India.

The six DIIs are HDFC Standard Life Insurance Company Limited, HDFC Asset Management Company Limited, Housing Development Finance Corporation Limited, ICICI Bank Limited, Kotak Mahindra Old Mutual Life Insurance Limited, Axis Bank Limited.