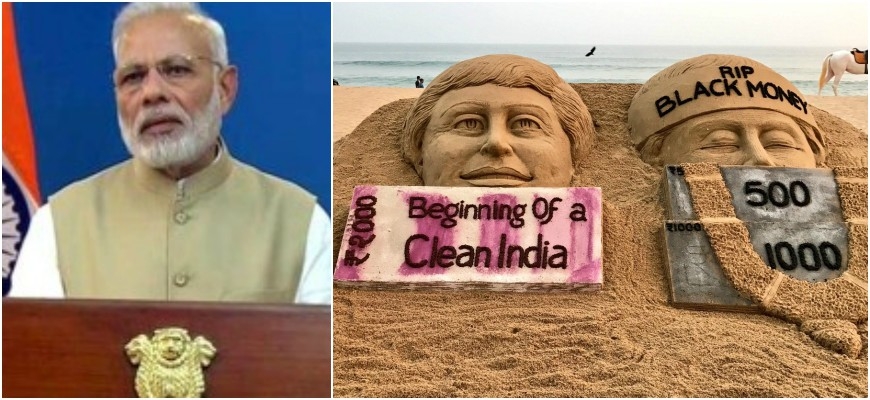

Impact of demonetization on black money

Total Views |

by Dr Abhijit Phadnis

In my article dated October 9, 2016, which appeared in Maharashtra Times, the largest circulating Marathi daily, I had dealt with a number of ways in which steps can be taken to fight the menace of black money in Indian economy. I had mentioned towards the close that the way digitization of economy and transactions is taking place, the notes of denominations 500 and above could be taken out of circulation in 3-4 years and if that is done, it will be a major step towards eradication of black money. It seems I had a premonition about what was coming in a month’s time from then, but I did not expect it will be so soon. It came in a different form, which involved remonetization; yet, it created a huge impact on the economy.

The same night, people who had access to unaccounted or corrupt money, queued up to buy gold. The prices shot up dramatically, albeit temporarily. People who had money which was not disclosed for tax purposes or who had obtained money from illicit sources were very concerned. Phones of CAs were ringing. Suddenly people who had no qualms in evading taxes wanted to be more compliant. Some rich people tried to shortchange poor, illiterate people by passing large denomination notes to them or paying for their services in advance, pushing the responsibility of dealing with the large denomination notes to the gullible, vulnerable strata of the society. Some rich people pushed their own drivers and domestic helpers to stand in multiple queues to exchange currency at bank counters. Bank managers and officers were overwhelmed with the sheer number of people turning up at the branches. Banks set up pandals and other arrangements to make it as comfortable for people as possible. People had to rush from ATM to ATM to meet their cash needs. Some convinced their payees to receive money electronically. There was a significant surge in digital payments. Some seemingly illiterate people from a few villages took giant strides in going completely cashless.

While people at large appreciated the intent of the government and its resolve to fight black money, many people were dismayed at RBI not coming out with clear communication, in a way useful to masses, about how they are managing the transition and how new denomination notes would be issued in circulation and by when. Rumour mills were running 24 hours. Channels noticed increased TRPs for demonetization related discussions. Indian people showed their culture and patriotism while many had to bear personal inconveniences during the wedding season. There was hardly any chaos in the society, though there were some efforts to create one.

On the other hand, socialist Venezuela had to withdraw the whole step after the chaos in their society and polity. Time magazine had carried an article in February 2016 how large denomination currency notes denominated in dollars, euros and such global currencies provide opportunities for crime and corruption and how their demonetization could help curb them. Yet, none of those authorities showed the resolve to take those steps.

The Prime minister of India showed the courage, at the risk of it being politically explosive. However, the later elections showed that masses in India may be illiterate but they are full of wisdom to understand the difference between political gimmicks and what is really good for the country. For those who had evaded taxes and lost opportunities of declaring their undisclosed income in the earlier Income Disclosure Schemes, the government provided an opportunity to come out clean though now at a stiff rate. Some people used the opportunity to come out clean by paying hefty taxes but at least enjoying the rest.

Corrupt government officers were in a tough situation as any unexplained cash would mean a blot on their service record. Some cash was routed through companies which were dormant for many years and suddenly became active. Later the Prime Minister Narendra Modi came hard on the shell companies and companies which have not been filing their annual returns and financial statements and barred them from operating their bank accounts. I had, as a few others, thought that some of the currency may not ever come back to bank accounts, particularly those held by government officers as they could not come out openly with their cash hoardings.

Yet, only 1% of the large denomination notes did not return indicating that either people opted to pay taxes and hold the rest like mentioned above or they managed to launder it through others or made deposits of up to Rs. 2,50,000 in multiple banks. However, 18 Lakh depositors came on the radar of tax authorities who collectively deposited close to Rs. 3,00,000 Crores into banks. Some estimates put the amount at even a higher level.

The number of tax assessees suddenly jumped for the year 2016-17 and personal tax collection has shown a rising trend in 2017-18 too when the economy’s growth rate has come down to 5.7%, though very temporarily. The last 5 years of UPA government were marked by hyperinflation and tremendous rise in prices of land and properties. As I recently argued in a Republic TV debate, this was all fueled by corrupt and untaxed money.

After demonetization, as I expected, the property prices have come under pressure, which is a good development for people at large and the country. With PAN getting linked with Aadhar and PAN and Aadhar with financial assets, it is going to be increasingly difficult to build sinful wealth. ‘Alakshmi’ has to give way to ‘Lakshmi’ !! In the days to come, I am sure steps would be taken to bring more transparency in the beneficial interest in land and properties too, making it increasingly difficult to hide black and corrupt money. Increasing use of digitization in service delivery mechanism and transparency in rules is reducing the interactions with government officials, thus eliminating the opportunity for corruption.

Clarity in rules and regulations will reduce the need for use of discretion by government officials, which builds an opportunity for speed money. GST is going to reduce tax evasion by businessmen and interestingly, far more business entities have sought registration under GST than the registrants under excise duty, service tax and VAT combined. While the way demonetization was administered could be hotly debated about its pros and cons; its message was loud and clear. The government did not hesitate to take action which impacted the entire adult populace of the country when it thought it would be a right step in eliminating corruption.

It would not hesitate to take actions which impact a small portion of the population: those who indulge in corruption, malpractices, tax evasion, terrorism financing, inciting terrorism and human trafficking. The signalling effect of demonetization, indicating the resolve of the government to act, to my mind, has been the most significant feature of this important step; which has signalled a change in the direction of the country and its destiny.