Don’t get misled by social media: No changes in link Aadhaar with bank, phone dates

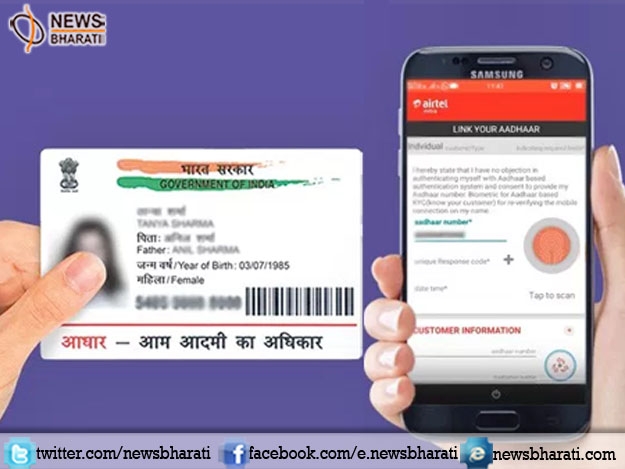

New Delhi, December 7: UIDAI, the authority which issues Aadhaar, said Thursday that the deadlines for verifying bank accounts, PAN cards and mobile SIM cards with the biometric ID stand valid and lawful, and there is no change in them.

Refuting social media messages, the Unique Identification Authority of India (UIDAI) said that as on date there is no stay from the Supreme Court on Aadhaar and its linking to various services.

“That Aadhaar Act being in force, all notifications for requiring Aadhaar for various welfare programmes, verifying bank account, PAN card and SIM card with Aadhaar stand valid and lawful,” it said in a statement.

“Today’s legal position is that there is no stay as on December 7, 2017 from the Supreme Court on Aadhaar and its linking to various services,” it added.

The government has made it mandatory for verifying bank account and PAN to weed out black money and bring unaccounted wealth to book. The same for SIM has been mandated to establish identify of mobile phone users.

“The mandatory requirements of Aadhaar for PAN, bank accounts, welfare programs, and SIM cards have been challenged in the Supreme Court and no stay has been granted. Therefore, it is clear that the video is outdated because it does not reflect the latest legal position as on today (December 7, 2017),” the statement said.

UIDAI asked people not to get misled by an outdated video doing rounds in the social media and Whatsapp and said “people should instead verify their banks accounts, investment accounts, SIM cards, etc as per the current laws and deadlines as early as possible to avoid any inconvenience.”

The government in June had made Aadhaar mandatory for opening bank accounts as well as for any financial transaction of Rs 50,000 and above. Also, the government had already mandated seeding of Aadhaar number with Permanent Account Number to avoid individuals using multiple PANs to evade taxes.