Good News! GST rates on 29 handicrafts items reduced to 0% slab

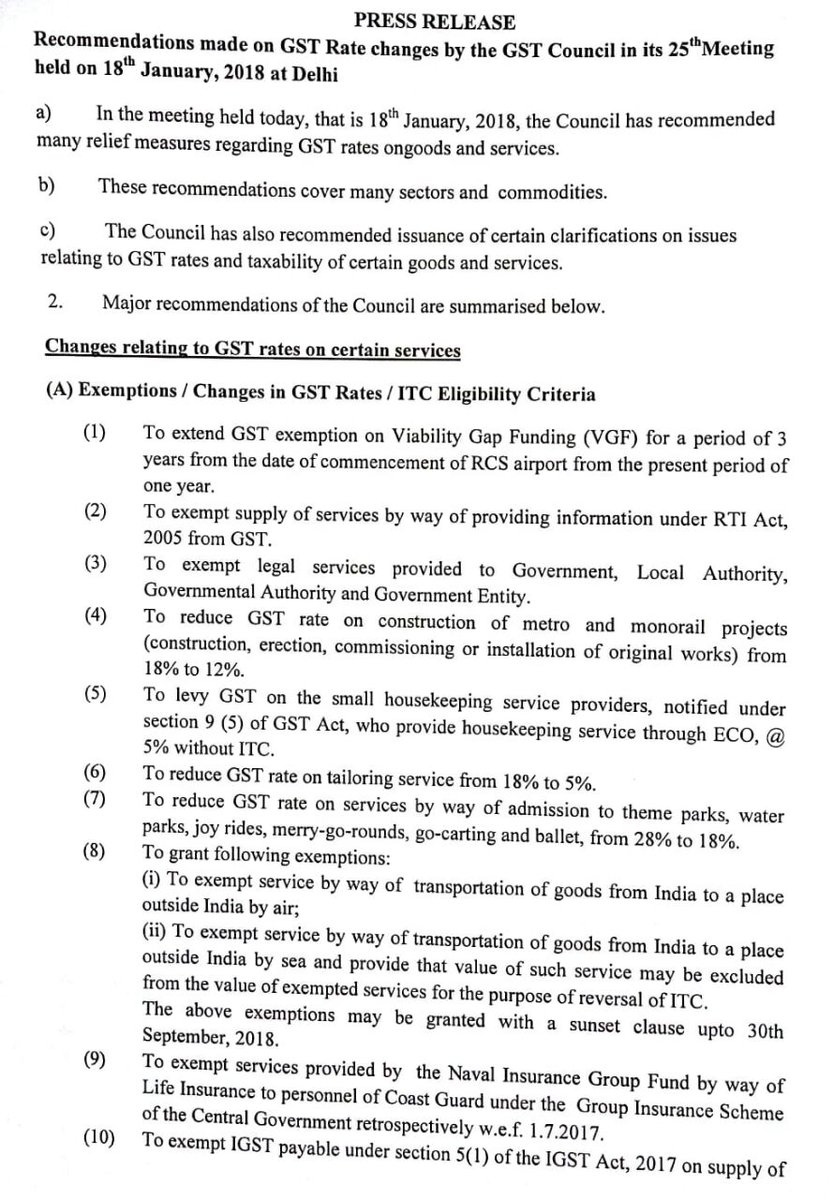

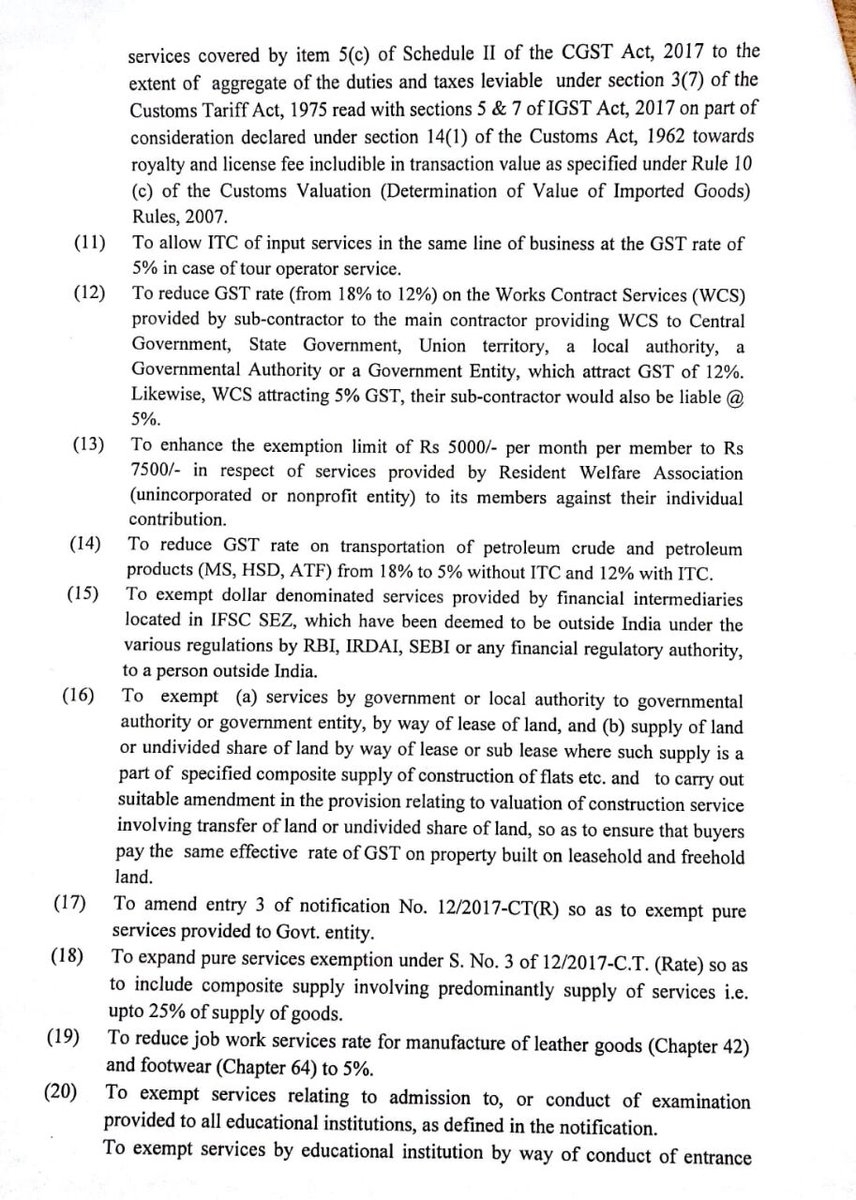

New Delhi, January 18: Goods and Services Tax (GST) Council in its 25th meeting on Thursday slashed the tax rate on 29 handicrafts items and also reduced the tax on around 53 categories of services.

While addressing a media, Finance Minister Arun Jaitley said that the GST council has brought 29 handicrafts items into 0% slab while taxes have also been reduced on around 53 categories of services. The revised GST rates will be applicable from January 25 of this year.

Further giving up the details, Finance Minister Arun Jaitley said that the council discussed the simplification of return filing process in the meeting. “Nandan Nilekani gave a detailed presentation on simplifying return filing process,” he added. However, the council has not yet finalized on any decision regarding simplifying the process of GST filing.

FM Jaitley also noted that the direction was that return filing under GSTR 3B will continue and the sellers and suppliers should load their invoices, after which details of supply made can be furnished. It is given that the 3B return between buyer and supplier will reflect the supplies made. If there is any difference between the two, at a later stage they can be asked to explain.

Jailtely further added that merely supply invoice should be loaded and on that basis tax deposits should be made. "Since there were three presentations, I can say that the direction is that initially there will be a 3B return and there will be a supplier invoice. This we think will be adequate and a simple system," FM Jaitley stated.

FM Jaitley said that the council was expected to do away with multiple return forms under GST by combining some forms. It was expected that GSTR-1 ,2 and 3 forms will be clubbed under one single simplified form for small traders and taxpayers eligible under the composition scheme. "GST Panel also decided to divide Rs 35,000 crore IGST collections between centre, states", Minister Jaitley added.

After being asked about the high prices of petrol and diesel, he said that the council did not reach any conclusion on bringing petroleum products and real estate under GST as the items were not discussed during the meet. “The GST Council may consider a decision petroleum and other exempt items,” The Finance Minister added.

Replying to a query on direct tax collections, the finance minister said that the government is well ahead of the target. Importantly, the council is expected to meet in the next 10 days via video conferencing, to deliberate upon the matter.

Earlier, in the 23rd meet that held in the month of November last year, the GST council slashed the tax rate on 177 goods. As per latest reports, of the 227 items placed in 28% GST slab, the tax rates of 177 items have been slashed to 18%, leaving 50 which are mostly luxury items.