Novel Governor to RBI, Shaktikanta Das promises to work in the interest of economy

Total Views |

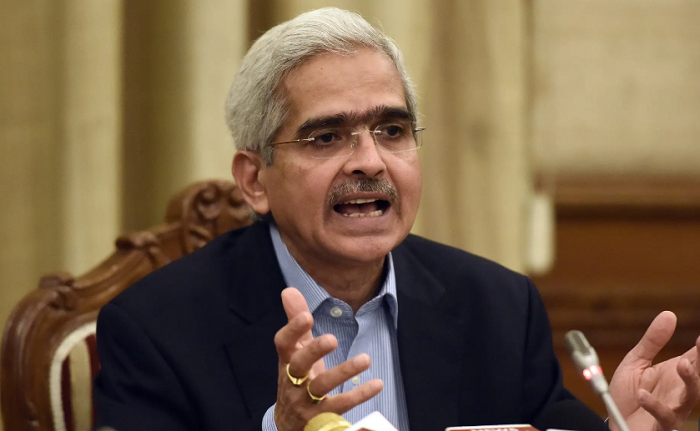

Mumbai, December 12: The newly appointed RBI Governor Shaktikanta Das addressed the media today in the state capital today focussing majorly upon the legacy of the Central Bank and the agendas of the same. Das took charge as the 25th Governor of the Reserve Bank after Urjit Patel stepped down citing personal reasons. “I note the stewardship provided by my predecessor Dr Urjit Patel to the RBI in the past 2 and half years. I convey my best wishes to Patel for all his future endeavors.”, said Das.

Das has however, planned to meet the Managing Directors and the CEOs of the public sector banks based in Mumbai tomorrow. “Banking being the important sector in the economy and it’s currently facing challenges which are of critical importance. Although the government has taken several measures in the past, many more need to be taken in relation.”, he added further.

“I would like to focus on the banking sector immediately followed by the other forms of stakeholder consultation if required. After few days I will hold a consultation with the chiefs of public sector banks located outside Mumbai. Subsequently at some stage, I will have an interaction with the private sector banks also to understand the issues related to them.”

However, the Central board meeting is scheduled to conducted on 14th of December this year aiming to converse the agendas and various other listed issues.

With no certain plans of making any major announcements he continued to say, “I will try my best to maintain the same, the core values, the policies and the credibility and the autonomy of the reserve bank. I am looking forward to work with the entire team of officers and staff of the reserve bank of India. This is a great opportunity for any individual to work in RBI and to serve the country. I will work in the best interest of the economy and take timely measures required by the economy.”

Focussing on the inflation, he said that the inflation however becomes the significant target after the amendment in the RBI Act. The inflation targeting is very important and it’s very heartening to note that inflation broadly as per the targets. The inflation outlook also looks fairly benign at this stage but we need to be watchful of the developments.

“Decision making in the modern times have become very complex and consultation with the stakeholders is very important. This adds value and depth to our understanding regarding issues. I propose to take consultation with the stakeholders at any possible matter if needed on various issues.” , he asserted further.

“The issue of health of public sector banks being an important issue, the issue of liquidity also comes up in the media space from time to time. That is again an area to interact with the stakeholders and get an internal feedback and then take a view on these issues. The maintenance of the growth trajectory of the Indian economy is also important. There are further several issues Central bank needs to deal with. All these issues however, had been under focus since long. But this becomes a part of continuous focus cycle of the Central bank”, he concluded.