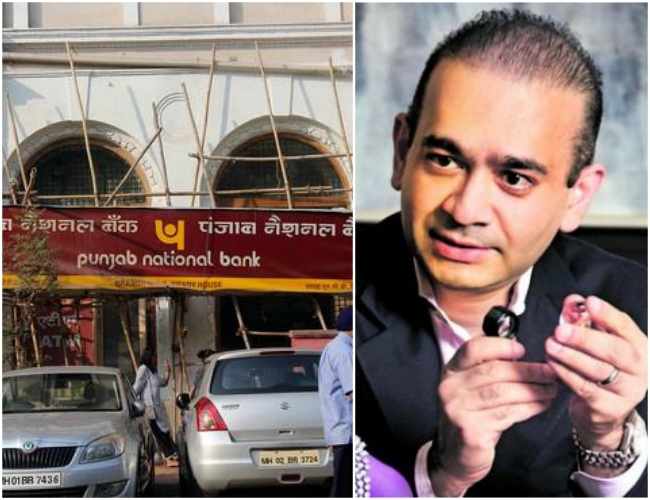

Punjab National Bank Scam: Billionaire Diamond Merchant Nirav Modi pops up in probe; PNB Stocks plunge by 10%

Mumbai, February 15: One of the biggest fraudulent case hit Mumbai on Wednesday where Punjab National Bank reported that it has detected fraudulent and unauthorized transactions in one of its branches in Mumbai. The cumulative fraud amounts to US $1,771.69 billion i.e. Rs 11,378.68 Crores.

In a probe Central Bureau of Investigation lodged a complaint against billionaire diamond merchant Nirav Modi and his wife Ami, brother Nishal, and uncle Mehul Choksi- MD of Gitanjali Gems (all partners of three companies: Diamond R US, Solar Exports and Stellar Diamonds) in the case.in a Rs 280-crore fraud. Two PNB officials, Gokulnath Shetty and Manoj Kharat, were also named for helping the businesspersons.

Punjab National Bank, in a letter said, "It has been reported through a preliminary investigation that the suspected fraud has been carried out by the perpetrators in collusion with the staff of one of our branches in Mumbai."

How?

Last year, Deputy Manager (now retired) Gokulnath Setty and single window operator Manoj Kharat had issued eight letters of understanding (LOU) worth over Rs 280 Crores to Nirav’s company. Gokulnath Setty retired in May. The LOUs were issued in February. The due date mentioned January 2018.

The letter by PNB said it was found through the SWIFT trail that one unauthorised junior-level official fraudulently issued Letters of Undertaking (LoUs) on behalf of some companies belonging to Nirav Modi Group.

Society for Worldwide Interbank Financial Telecommunication (SWIFT), the global financial messaging service is used to transfer millions of dollars internationally, was primarily used to bypass the core banking system (CBS) which processes daily banking transactions. It was a ploy to avoid immediate detection as the SWIFT messages used to raise overseas credit were not readily available in PNB’s FINACLE software system.

FIR stated that “the public servants committed abuse of official position to cause pecuniary advantage to Diamond R US, Solar Exports, Stellar Diamonds and wrongful loss of (over Rs 280 Crores) to PNB during 2017.”

The Enforcement Directorate has also initiated a money laundering case against the Modis. The agency also filed the case under the Prevention of Money Laundering Act (PMLA) after going through a CBI FIR filed early this month. This has impacted PNB stocks sinking nearly 8% lower on the Bombay Stock Exchange. Also four big jewellers, Gitanjali, Ginni, Nakshatra and Nirav Modi, are now under scanner.

“The Bank has detected some fraudulent and unauthorized transactions in one of its branch in Mumbai for the benefit of a few select account holders with their apparent involvement. Based on these transactions other banks appear to have advanced money to these customers abroad,” PNB said. According to the bank, these transactions are contingent in nature and liability arising out of it shall be decided based on the law and genuineness of underlying transactions. The bank has referred this matter to law enforcement agencies to examine and book the culprits as per law of the land.