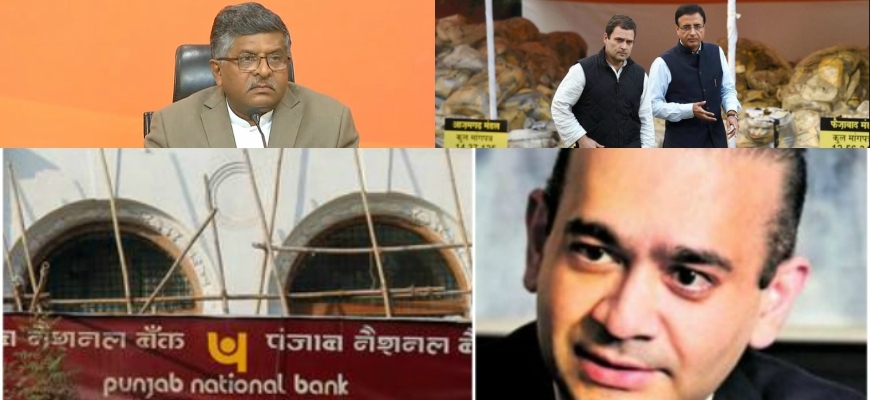

Ravi Shankar Prasad hits out at Congress for linking Nirav Modi with PM Modi in #PNBScam; says guilty will not be spared

Notably, as soon as Punjab National Bank detected fraudulent and unauthorized transactions worth Rs 11,378.68 Crores in one of its branches in Mumbai, opposition Congress Party blamed Prime Minister Narendra Modi for the corruption. Congress Spokesperson Randeep Surjewala named Nirav Modi as ‘Chhota Modi’ and directly linked him with PM Modi.

Law Minister Ravi Shankar Prasad, during a press conference severely criticized Congress Party and said that linking Nirav Modi with PM Modi is shameful and calling him as ‘Chhota Modi’ is derogatory, scandalous and demeaning. Ravi Shankar Prasad also stated that the central government will not spare guilty in Punjab National Bank scam.

He said, “What is this word 'Chhota Modi' ? It is derogatory, scandalous and demeaning.” “I wish to make it very clear and this I can also convey on the behalf of the government that no shall be spared in the banking system who has sought to derail ordinary banking system to help Nirav Modi,” he added.

Clarifying on Rahul Gandhi’s tweet over Nirav Modi’s meeting with PM Modi in Davos, the Law Minister said, “PM Modi did not meet Nirav Modi at Davos,” “Nirav Modi had arrived in Davos on his own and was present at CII group photo event.”

Regarding photos making social media rounds of him along with PM Modi in the recent World Economic Forum, Ravi Shankar Prasad said that Nirav Modi was never part of PM's delegation to Davos. He further warned Congress of politicizing the matter. “Many good and cosy photographs of many of the Congress leaders with Mehul Choksi is available with us, but we don't want to stoop to that level,” he concluded.

Earlier, in the day, Congress spokesperson Randeep Surjewala held a press conference and lashed out at the government and demanded accountability, responsibility and recovery of the money and answers on who had protected another 'Chhota Modi' and helped him flee the country.

Accusing the NDA government of trampling upon the entire banking system, Surjewala said risk management system, fraud detection ability' and the regulatory mechanism of banks have been severally compromised under the Modi government.

Alleging that "loot and escape" had become the hallmark of the Modi government, Surjewala said: "Post-escape of 'Lalit Modi' i.e. 'Chhota Modi' and 'Vijay Mallya', another 'Modi scam' has hit India's banking sector the hardest. First, Lalit Modi escaped. Vijya Mallya escaped. ABG's Rishi Agarwal escaped. Now, we are told that Nirav Modi has also escaped."

Posing questions to the Prime Minister, the Congress spokesperson asked how Nirav Modi and his uncle Mehul Choksi duped the entire banking system through forged letters of understanding under the nose of his government. “Who is responsible for the biggest 'bank loot scam," Surjewala queried, asking why the Prime Minister did not take any action to protect the banking sector from the fraud despite a written complaint received in July 2016.

"Why were all the authorities, including Finance Ministry, its financial intelligence units and all other authorities sleeping?" Meanwhile, Congress Chief Rahul Gandhi also launched an attack on PM Modi and government. He is a tweet said, "Guide to Looting India by Nirav MODI

1. Hug PM Modi

2. Be seen with him in DAVOS

Use that clout to:

A. Steal 12,000Cr

B. Slip out of the country like Mallya, while the Govt looks the other way."

BACKGROUND:

One of the biggest fraudulent case hit Mumbai on Wednesday where Punjab National Bank reported that it has detected fraudulent and unauthorized transactions in one of its branches in Mumbai. The cumulative fraud amounts to US $1,771.69 billion i.e. Rs 11,378.68 Crores.

In a probe, Central Bureau of Investigation lodged a complaint against billionaire diamond merchant Nirav Modi and his wife Ami, brother Nishal, and uncle Mehul Choksi- MD of Gitanjali Gems (all partners of three companies: Diamond R US, Solar Exports and Stellar Diamonds) in the case.in a Rs 280-crore fraud. Two PNB officials, Gokulnath Shetty and Manoj Kharat, were also named for helping the businesspersons.

How?

Last year, Deputy Manager (now retired) Gokulnath Setty and single window operator Manoj Kharat had issued eight letters of understanding (LOU) worth over Rs 280 Crores to Nirav’s company. Gokulnath Setty retired in May. The LOUs were issued in February. The due date mentioned January 2018.

The letter by PNB said it was found through the SWIFT trail that one unauthorised junior-level official fraudulently issued Letters of Undertaking (LoUs) on behalf of some companies belonging to Nirav Modi Group.

Society for Worldwide Interbank Financial Telecommunication (SWIFT), the global financial messaging service is used to transfer millions of dollars internationally, was primarily used to bypass the core banking system (CBS) which processes daily banking transactions. It was a ploy to avoid immediate detection as the SWIFT messages used to raise overseas credit were not readily available in PNB’s FINACLE software system.

FIR stated that “the public servants committed abuse of official position to cause pecuniary advantage to Diamond R US, Solar Exports, Stellar Diamonds and wrongful loss of (over Rs 280 Crores) to PNB during 2017.”

The Enforcement Directorate has also initiated a money laundering case against the Modis. The agency also filed the case under the Prevention of Money Laundering Act (PMLA) after going through a CBI FIR filed early this month. This has impacted PNB stocks sinking nearly 8% lower on the Bombay Stock Exchange. Also four big jewellers, Gitanjali, Ginni, Nakshatra and Nirav Modi, are now under scanner.

“The Bank has detected some fraudulent and unauthorized transactions in one of its branch in Mumbai for the benefit of a few select account holders with their apparent involvement. Based on these transactions other banks appear to have advanced money to these customers abroad,” PNB said. According to the bank, these transactions are contingent in nature and liability arising out of it shall be decided based on the law and genuineness of underlying transactions. The bank has referred this matter to law enforcement agencies to examine and book the culprits as per law of the land.

PNB MD Sunil Mehta’s Press Conference

Punjab National Bank (PNB) Managing Director (MD) Sunil Mehta said that the bank's Rs 11,300 crore scam had started back in 2011 and it was detected on January 3 this year. "We detected the fraud on January 3. We got to know that 2 of our employees did some un-authorised transactions. The bank intiated criminal action against our staff members," he said.

He said that the bank lodged a complaint with the CBI on January 29, following which the investigation agency registered an FIR on the next day. "In response to our registered FIR, raids are being conducted on involved groups and establishments, documents and records are being seized," he said.

On the other side, the Enforcement Directorate (ED) registered a money laundering case against diamond merchant Nirav Modi and his relatives along with others and raided over dozen premises across the country connected to them.

The premises raided by the ED include Modi's residence in Kurla, his jewellery boutique in Kala Ghoda area, three company locations in Bandra and Lower Parel, three premises in Surat in Gujarat and Modi's showrooms in Chanakyapuri and Defence Colony in Delhi.

No link of Nirav Modi’s Escape with the Central Government:

Nirav Modi and his brother Nishal Modi left the country on 1st of January this year. Nirav Modi's wife, an American citizen, left India on 6 January while Mehul Choksi left the country on 4 January. CBI received a complaint from PNB on 29th Jan 2018. CBI registered the case on 31st January and immediately issued lookout circulars.