ED issues fresh summon against Nirav Modi in #PNBScam

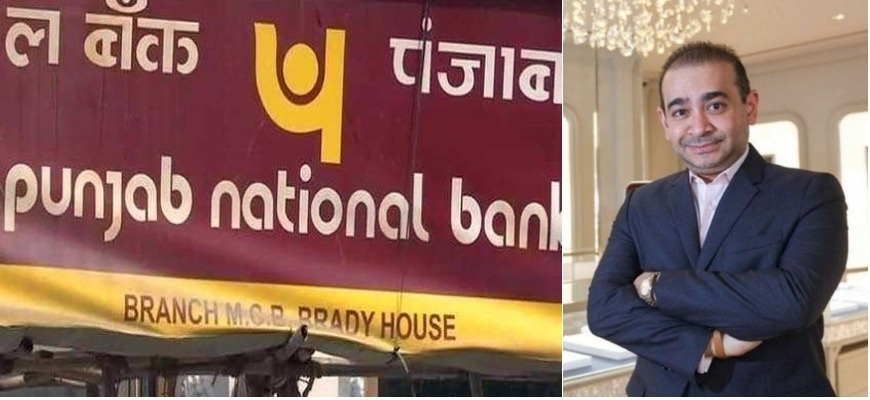

Mumbai, February 23: The Enforcement Directorate (ED) on Thursday issued fresh summon to Nirav Modi after he failed to appear before the probe agency in the Rs 11,378.68 Crores Punjab National Bank (PNB) loan fraud case.

ED has summoned Nirav Modi under the Prevention of Money Laundering Act and has been asked to join the investigation and appear before the central probe agency in Mumbai on 26th February. On the other side, Income Tax Dept has attached SEZ property of Gitanjali Group in Hyderabad.

Meanwhile, the Institute of Chartered Accountants of India (ICAI) has also started its investigation as per the Chartered Accountants Act, 1949 and rules framed under Chartered accountants' apex body. ICAI taking a strict action in connection with the case has issued show-cause notices to the auditors of Punjab National Bank and Gitanjali Gems.

The ICAI has also written to the RBI requesting it to provide the list of the corporate borrowers of public sector banks having the outstanding loan amount of 2,000 crore rupees and above.The list would be examined by the Financial Reporting Review Board of ICAI for any possible violation of applicable standards of accounting as well as auditing.

However, the ICAI has also written to the Ministry of Corporate Affairs requesting it to ask SEBI, CBI, ED and PNB to share their findings to enable it to accelerate the action against any chartered accountant who has any role in this fraud.

The move comes after a special court in Mumbai on Wednesday sent Vipul Ambani a senior executive in Nirav Modi's company and five others to CBI custody till March 5th in connection with the Scam. The six who were given in custody of CBI are Firestar International’s president (finance), Vipul Ambani, Nakshatra Group Chief Financial Officer Kapil Khandelwal, Niten Shahi, a manager at Gitanjali Gems, Kavita Mankikar, the authorized signatory of three companies accused of fraud, and Arjun Patil, a senior executive at Firestar.

Billionaire Diamond Jeweller Nirav Modi, Mehul Choksi and others are being investigated by multiple probe agencies after a recent complaint by the PNB, that they allegedly cheated the bank to the tune of 11,400 crore rupees. After the scam was unveiled, the Enforcement Directorate registered an FIR under the Prevention of Money Laundering Act against Nirav Modi and his Mumbai-based firms Diamonds R Us, Solar Exports and Stellar Diamonds.

CBI also registered fresh FIRs against 10 directors of the Gitanjali Group of companies on charges of criminal conspiracy and cheating under the Indian Penal Code (IPC) and Prevention of Corruption Act, including Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based in Mumbai's Walkeshwar. The FIR also named two former bank employees said to be directly involved in the fraudulent transactions.

CBI sealed Brady House branch of Punjab National Bank in Mumbai from where the Rs 11,378.68 Crores PNB scam was originated and arrested GM level officer Rajesh Jindal. Rajesh Jindal was a branch head at Punjab National Bank Brady House branch. Dozens of the raid are already conducted in this case.

Meanwhile, the Ministry of External Affairs decision was based on the advice of the Enforcement Directorate (ED), which filed money laundering cases against Modi and Choksi in relation to the alleged Rs 11, 400 crore PNB fraud. MEA has also asked Modi and Choksi to respond within one week and justify why their passports should not be revoked.

Importantly, Nirav Modi and his brother Nishal Modi left the country on 1st of January this year. Nirav Modi's wife, an American citizen, left India on 6 January while Mehul Choksi left the country on 4 January. CBI received a complaint from PNB on 29th Jan 2018 and registered the case on 31st January.