After multi-crore PNB fraud, another bank scam unearthed in Chennai worth Rs 824 Cr involving Kanishk Jewellers

Chennai, March 22: While India has still not mentally settled down with multi-crore PNB fraud, another bank scam worth Rs 824.15 Crores has been unearthed in Tamil Nadu. 14 nationalized and private banks subsuming the State Bank of India and the Punjab National Bank have been allegedly duped by popular jewellery chain Kanishk Gold owned by Bhoopersh Kumar Jain.

A consortium of banks led by the State Bank of India (SBI) has lodged a complaint with the Central Bureau of Investigation (CBI) on Wednesday to investigate Kanishk Gold Private Limited (KGPL) for Rs 824.15 Crores loan fraud.

According to the complaint by SBI, Kanishk Gold, which has a registered office in T Nagar, Chennai, is owned by promoters and directors Bhoopesh Kumar Jain and his wife Neeta Jain. SBI has claimed that it is unable to contact the couple who is believed to be residing in Mauritius. Kanishk Gold did not answer calls. E-mails and calls to SBI remained unanswered.

In its complaint, the SBI-led group has alleged that "Kanishk Gold and its directors in collusion with statutory auditors" had a "clear criminal/malafide intent" to "cheat and defraud" the banks and to "gain illegal profit" by "misrepresenting/falsifying the record and financial statements of the company".

According to SBI's complaint, the loans to Kanishk Gold date 2007 onwards. Over a period of time, banks increased the credit limit and working capital loan limit to Kanishk Gold. In 2008, SBI took over the loans from ICICI Bank when the working capital loan limit was Rs 50 crore and the term loan limit was Rs 10 crore.

In March 2011, the entire amount was converted into a multiple banking arrangement with Punjab National Bank and Bank of India.

In 2012, the consortium with SBI as lead bank sanctioned granting of metal gold loan (MGL) to Kanishk Gold. Using this option, "Kanishk used to purchase gold in the form of bullion either from nominated banks in the consortium or from the open market by utilising credit under MGL or from under current account," said SBI in its complaint.

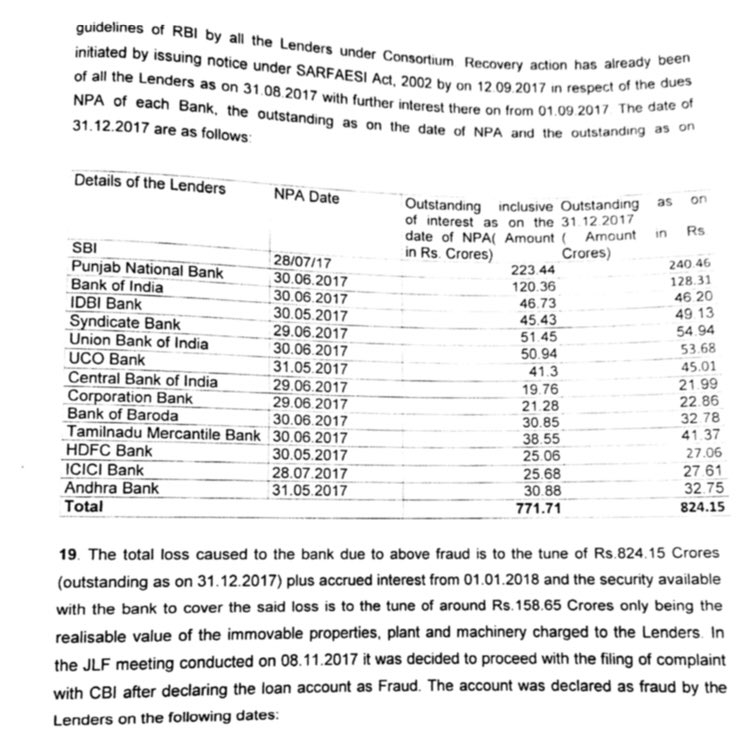

In the next few years, State Bank of India extended loans to Kanishk Gold worth Rs 215 crore, Punjab National Bank gave Rs 115 crore, Union Bank of India Rs 50 crore, Syndicate Bank Rs 50 crore, Bank of India Rs 45 crore, IDBI Bank of Rs 45 crore, UCO Bank Rs 40 crore, Tamilnad Mercantile Bank Rs 37 crore, Andhra Bank Rs 30 crore, Bank of Baroda Rs 30 crore, HDFC Bank Rs 25 crore, ICICI Bank Rs 25 crore, Central Bank of India Rs 20 crore and Corporation Bank Rs 20 crore.

According to the complaint, Kanishk jeweller first defaulted on payments of interests to eight banks in March 2017, and from April 2017 it stopped giving payments to all 14 banks.

"The promoter was unavailable for follow up. When the stock audit was initiated on 05.04.2017 for the quarter March 2017, the company did not facilitate stock and receivables audit process. Subsequently on 27.05.2017, consortium members visited the corporate office factory and showrooms and found that there was no activity," the complaint to CBI read.

According to the banks' complaint, "On the same day, Bhoopesh Kumar Jain gave a letter admitting falsification of records since 2009 and removal of the stocks secured to the lenders". A physical inspection revealed that there was no activity at the factory and all showrooms Kanishk Gold were found locked.

In November, SBI declared to the Reserve Bank of India (RBI) that the account of Kanishk Gold was fraudulent. By January, other banks of the consortium had declared the account as fraudulent to the regulator. Declaration of fraud by ICICI Bank and Andhra Bank is under process, according to the complaint.

SBI, in its complaint to the agency, has named Kanishk Gold, its promoters and directors Bhoopesh Kumar Jain and Neeta Jain, Tejraj Achha who is a partner of Achha Associates, Ajay Kumar Jain who is a partner in Ajay and Co. (Crescent Court), Sumit Kedia who is a partner at Lunawath and Associates, as well as unnamed public servants.