Delhi High Court seeks ED reply to Nirav Modi’s plea of searching his properties in #PNBScam

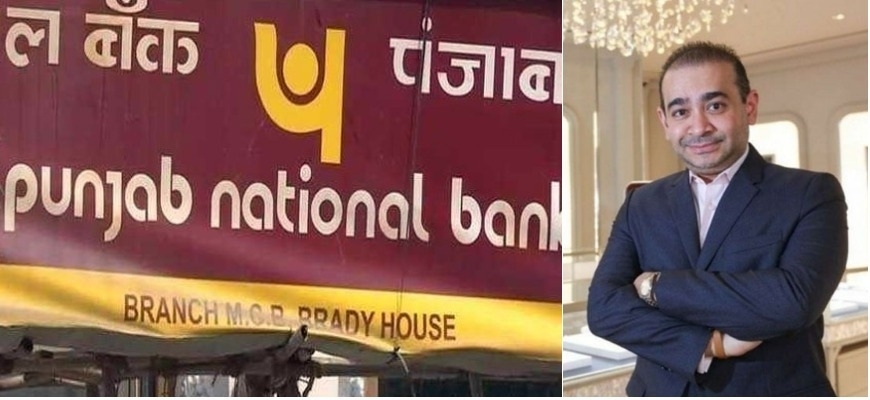

New Delhi, March 7: The Delhi High Court on Wednesday issued a notice to the Enforcement Directorate (ED) after billionaire jeweler Nirav Modi’s company Firestar Diamond International filed a plea challenging the probe agency’s authority to search its properties in the Rs 12,700-crore Punjab National Bank loan fraud case. Notably, Nirav Modi is accused of cheating the Punjab National Bank of Rs 12,703 crore.

The Firestar Diamond in its petition challenged the provisions of the Prevention of Money Laundering Act that allowed the agency to search and seize the company’s properties and sought a copy of the search warrants from the Finance Ministry and ED. However, Nirav Modi’s firm Firestar Diamond also sought to have quashed the investigative agency’s decision to attach movable property and deposit the same with the Punjab National Bank.

The High Court bench comprising justices S Muralidhar and IS Mehta after hearing asked ED to file reply till March 19. However, High Court refrained from staying the investigations against the company and said it will make a decision only after the agency files its response.

On Friday last week, a special Court in Mumbai granted custody of Punjab National Bank's Retired Internal Chief Auditor Bishnubrata Mishra to CBI till the 14th of March in connection with the Rs 12,700-crore Punjab National Bank loan fraud case. Earlier, CBI arrested PNB’s internal chief auditor MK Sharma who was allegedly responsible for auditing the systems and practices of PNB’s Brady House branch and report deficiencies to the zonal audit office.

On March 3, a special court had also issued a non-bailable warrant against Nirav Modi after he failed to honour the three summons issued to him to appear before ED for investigation. On the other side, Income tax department has attached four more properties of Nirav Modi group in the tax evasion case.

Importantly, Billionaire Diamond Jeweller Nirav Modi, Mehul Choksi and others are being investigated by multiple probe agencies after a recent complaint by the PNB, that they allegedly cheated the bank to the tune of 11,400 crore rupees.

After the scam was unveiled, the Enforcement Directorate registered an FIR under the Prevention of Money Laundering Act against Nirav Modi and his Mumbai-based firms Diamonds R Us, Solar Exports and Stellar Diamonds.

CBI also registered fresh FIRs against 10 directors of the Gitanjali Group of companies on charges of criminal conspiracy and cheating under the Indian Penal Code (IPC) and Prevention of Corruption Act, including Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based in Mumbai's Walkeshwar. The FIR also named two former bank employees said to be directly involved in the fraudulent transactions.

CBI sealed Brady House branch of Punjab National Bank in Mumbai from where the Rs 11,378.68 Crores PNB scam was originated and arrested GM level officer Rajesh Jindal. The Ministry of External Affairs revoked the passports of Nirav Modi and Mehul Choksi. The decision was based on the advice of the Enforcement Directorate (ED), which filed money laundering cases against Modi and Choksi.

Nirav Modi and his brother Nishal Modi left the country on 1st of January this year. Nirav Modi's wife, an American citizen, left India on 6 January while Mehul Choksi left the country on 4 January. CBI received a complaint from PNB on 29th Jan 2018 and registered the case on 31st January.

On February 14 this year, one of the biggest fraudulent case hit Mumbai where Punjab National Bank reported that it has detected fraudulent and unauthorized transactions in one of its branches in Mumbai. The cumulative fraud amounts to US $1,771.69 billion i.e. Rs 11,378.68 Crores.