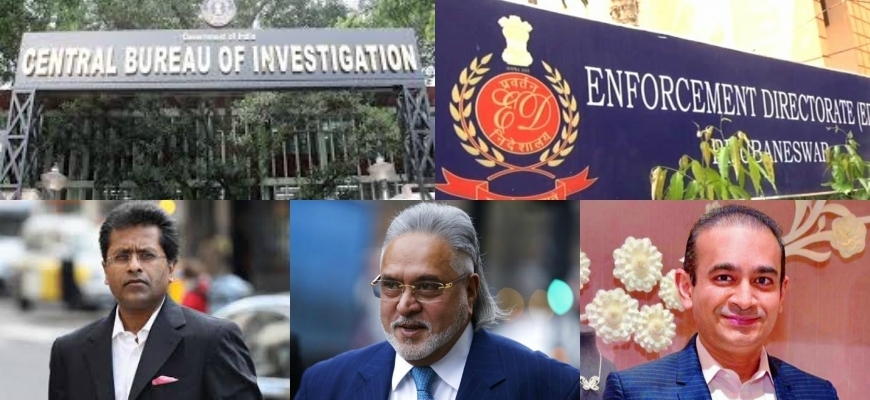

Fugitive Economic Offenders Ordinance 2018 active now; fraudulent, economic absconders to be punished soon

New Delhi, April 21: In a bid to punish the fraudulent who cheat banks and escape from the country, the central government on Saturday approved Fugitive Economic Offenders Ordinance 2018 that provides for confiscating properties and assets of economic offenders.

Earlier it was easy for business tycoons like Vijay Mallya, Mehul Choksi and Nirav Modi to fool banking systems and leave the country easily without any punishment. But now if anyone dares to cheat, then be ready for property seizure as well. The Union Cabinet chaired by PM Modi approved a proposal to promulgate Fugitive Economic Offenders Ordinance 2018 that provides for confiscating properties and assets of economic offenders like loan defaulters who escape from the country.

The law which will immediately come into effect after the assent of the President Ram Nath Kovind will empower law enforcement agencies to confiscate the assets of economic absconders till they submit to the jurisdiction of law in India. The law would also help in laying down measures to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts. The cases where the total value involved in such offences is Rs.100 crore or more will come under the purview of this law.

Salient features of the Law:

- Application before the Special Court for a declaration that an individual is a fugitive economic offender;

- Attachment of the property of a fugitive economic offender;

- Issue of a notice by the Special Court to the individual alleged to be a fugitive economic offender;

- Confiscation of the property of an individual declared as a fugitive economic offender resulting from the proceeds of crime;

- Confiscation of other property belonging to such offender in India and abroad, including benami property;

- Disentitlement of the fugitive economic offender from defending any civil claim; and

- An Administrator will be appointed to manage and dispose of the confiscated property under the Act.

If at any point of time in the course of the proceeding prior to the declaration, however, the alleged Fugitive Economic Offender returns to India and submits to the appropriate jurisdictional Court, proceedings under the proposed Act would cease by law. All necessary constitutional safeguards in terms of providing hearing to the person through counsel, allowing him time to file a reply, serving notice of summons to him, whether in India or abroad and appeal to the High Court have been provided for. Further, provision has been made for the appointment of an Administrator to manage and dispose of the property in compliance with the provisions of law.

However, the law also makes provisions for a Court ('Special Court' under the Prevention of Money-laundering Act, 2002) to declare a person as a Fugitive Economic Offender. A Fugitive Economic Offender is a person against whom an arrest warrant has been issued in respect of a scheduled offence and who has left India so as to avoid criminal prosecution, or being abroad, refuses to return to India to face criminal prosecution.

A scheduled offence refers to a list of economic offences contained in the Schedule to this Bill. Further, in order to ensure that Courts are not over-burdened with such cases, only those cases where the total value involved in such offences is 100 crore rupees or more, is within the purview of this law.

Importantly, Fugitive Economic Offenders Bill, 2018 was already tabled in the budget session of Parliament but unnecessary ruckus, disruption, bombarding echoes in both the houses by the opposition led to the stalling of this crucial bill.

Background:

There have been several instances of economic offenders fleeing the jurisdiction of Indian courts, anticipating the commencement, or during the pendency, of criminal proceedings. The absence of such offenders from Indian courts has several deleterious consequences - first, it hampers investigation in criminal cases; second, it wastes precious time of courts of law, third, it undermines the rule of law in India. Further, most such cases of economic offences involve non-repayment of bank loans thereby worsening the financial health of the banking sector in India.