CBI files charge sheet against former PNB chief Usha Ananthasubramanian, others in Rs 13,000 crore scam

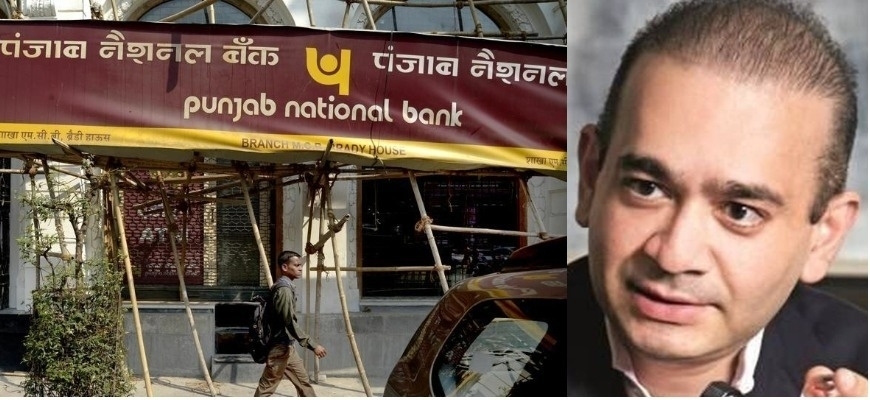

Mumbai, May 14: The Central Bureau of Investigation (CBI) on Monday filed its first charge sheet in the Rs 13,000 crore Punjab National Bank (PNB) scam involving billionaire jeweler Nirav Modi, detailing the alleged role of the bank's former chief Usha Ananthasubramanian.

Notably, the CBI has filed its first charge sheet in the Rs 13,000 crore PNB scam detailing the alleged role of the bank's former chief Usha Ananthasubramanian who is now CEO and MD of Allahabad Bank and other top officials. Usha Ananthasubramanian was the MD and CEO of PNB from 2015 to 2017 and was questioned recently by the CBI in connection with the case.

The CBI also named PNB executive directors K V Brahmaji Rao and Sanjiv Sharan, and general manager in its charge sheet. The probe agency in its first charge sheet has also detailed the roles of Nirav Modi, his brother Nishal Modi and Subhash Parab, an executive in Nirav Modi's company in the Rs 1300 crore mega scam.

The charge sheet basically deals with the first FIR registered in the case relating to the fraudulent issuance over Rs 6,000 crore of Letters of Undertaking to Diamond R US, Solar Exports and Stellar Diamonds. However, the agency has not given in detail the role of Mehul Choksi in the present charge sheet. It is likely to come up when the CBI files supplementary charge sheets in the case related to the probe of the Gitanjali group.

The development comes nearly three months after the biggest fraudulent case hit Mumbai in the month of February where Punjab National Bank reported that it has detected fraudulent and unauthorized transactions in one of its branches in Mumbai. The cumulative fraud amounts stand to Rs 13000 crores.

After the scam was unveiled, the Enforcement Directorate registered an FIR under the Prevention of Money Laundering Act and conducted raids after the surfacing of the alleged fraud by billionaire diamond trader Nirav Modi and his Mumbai-based firms Diamonds R Us, Solar Exports and Stellar Diamonds.

On the other side, the CBI also registered FIRs against 10 directors of the Gitanjali Group of companies on charges of criminal conspiracy and cheating under the Indian Penal Code (IPC) and Prevention of Corruption Act, including Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based in Mumbai's Walkeshwar. The FIR also named two former bank employees said to be directly involved in the fraudulent transactions.

Intensifying the probe, CBI sealed Brady House branch of Punjab National Bank in Mumbai from where the Rs 11,378.68 Crores PNB scam was originated. The action was based on EDs raid at over 45 more locations in 15 cities across India in connection with the multi-crore Punjab National Bank (PNB) scam.

In March, the Ministry of External Affairs confirmed that the fugitive offender Nirav Modi, who was involved in more than Rs 13,000 PNB scam is in Hong Kong. However, Indian authorities have already sought the provisional arrest of Nirav Modi to Hong Kong.

Importantly, Nirav Modi and his brother Nishal Modi left the country on 1st of January this year. Nirav Modi's wife, an American citizen, left India on 6 January while Mehul Choksi left the country on 4 January. CBI received a complaint from PNB on 29th Jan 2018and registered the case on 31st January.