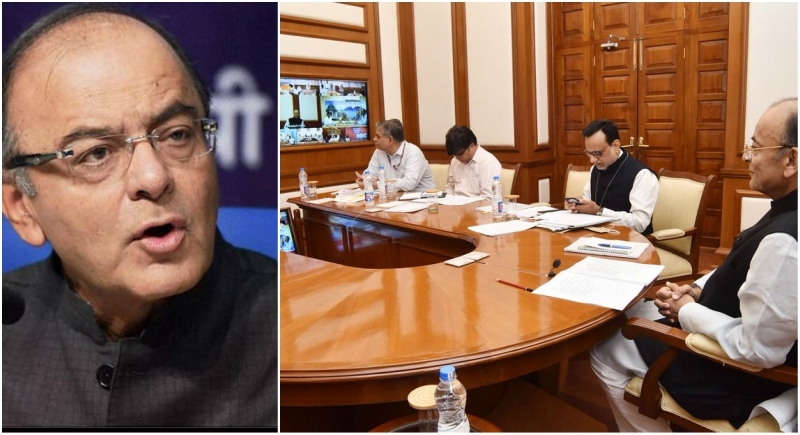

FM Arun Jaitley chairs the 27th GST Council meeting intending to simplify returns filing process

New Delhi, May 4: Commencing the 27th Goods and Service Tax Council meeting, Finance Minister Arun Jaitley chaired the meeting via a video conference in New Delhi today. The meeting entails in bringing the GSTN within complete government ownership and further discuss on issues like whether or not to levy Cess Tax on sugar.

Expressing satisfaction in the revenue growth, having a backdrop of the GST returns from the month of April, the meeting has garnered insights of making improvements and simplifying returns filing process. Stating the agendas the council members discussed Finance Minister Arun Jaitley described that the collection of GST completely on government. The process of simplification model will be set up in 6 months.

He further described that the ownership structure of the GSTN 49% by government, 51% held by other entities. Suggestions of this shareholding og 51% should be taken by govt and divided between state and centre. 51% private entities should be taken by government. Eventually Central government should hold 50% and state govts will hold 50% collectively. The collective share of state governments will be pro-rata divided among the states as per their GST ratios.

GSTN employ people contractually and flexibility best talents from market considering wide range of activities by GSTN.

Next agenda which the council discussed was on incentive on digitized payment, the issue was whether on digital payment either through banking or cheque mode or any form of digitized mode, 2% incentive should be given.

The majority was in favor of this suggestion, two alternative views. While some were on negative side the others had a positive approach. The team who accepted this, were of the view by having a list of negative items on which incentives will not be available. In this regard a committee of 5 ministers will be associated.

Imposition on cess on sugar particularly considering the cost of sugar increasing beyond Rs 35 per kg and market price is Rs 28-26kg and farmers are in great distressed. After GST has been implemented, how are these things addressed.

Sugarcane farmers are in deep distress. A separate group of 5 ministers within 2 weeks will make a recommendation to meet contingency of this kind when the cost of a commodity is higher than its selling price. Committee will be announced within next 2 days.

In all the meeting is sought to have positive impact on the people giving a complete upswing in the economy in the country.