RBI puts burden of more 25 points on Banks: Repo rate increased from 6.25 to 6.50

New Delhi, August 1: After a gap of nearly 2 months, the Monetary Policy Committee, MPC, of the Reserve Bank of India today hiked repo rate by 25 basis points to 6.50 percent in its third bi-monthly monetary policy review of 2018-19.

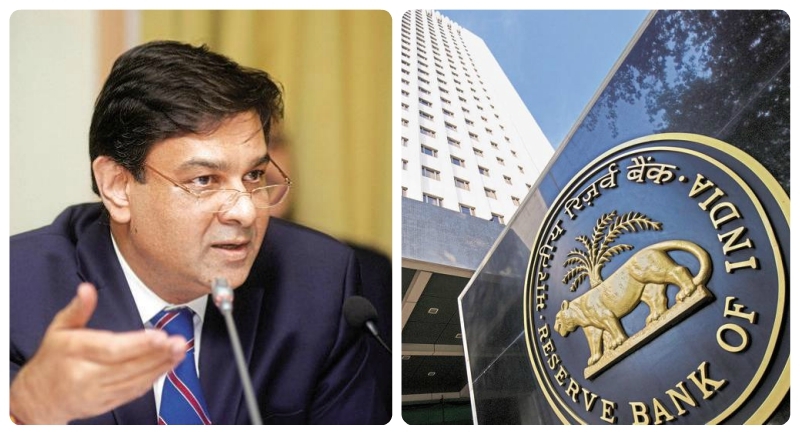

For the second consecutive time, the six-member MPC headed by RBI Governor Urjit Patel has hiked the key policy repo rate by 25 basis points. Repo rate is the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds.

Here are the points to be noted:

Reverse repo rate, the rate at which the Reserve Bank borrows money from commercial banks within the country, was adjusted to 6.25 per cent. Accordingly, the Marginal Standing Facility rate and the Bank Rate too stand adjusted at 6.75 per cent.

RBI has maintained neutral stance with an objective of achieving the medium-term target for headline inflation of 4 per cent while supporting growth.

The Reserve Bank today retained the GDP forecast for the current fiscal at 7.4 per cent on robust corporate earnings and buoyant rural demand, though it flagged global trade tensions for Indian exports.

It said, various indicators suggest that economic activity has continued to be strong. It noted that the progress of the monsoon so far and a sharper than the usual increase in MSPs of Kharif crops are expected to boost rural demand by raising farmers' income.

RBI has projected inflation to stay at 4.8 per cent in the second half of the current fiscal and is likely to touch 5 per cent in the first quarter of 2019-20.

Now the eyes are towards its next meeting to be held between 3rd and 5th October, 2018.