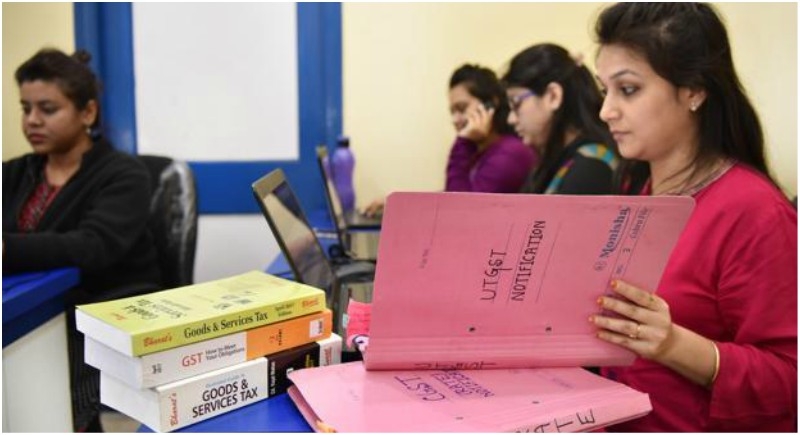

Govt puts board of due date for filing GST returns

New Delhi, August 11: The government has modified the due date for filing of final GST sales returns by businesses with a turnover exceeding 1.5 crore rupees to the 11th day of the succeeding month. In a notification issued on Friday, Central Board of Indirect Taxes and Customs (CBIC) has stipulated that details of outward supplies for July 2018 to March 2019 has to be filed by the 11th of the succeeding month.

Currently, such businesses are required to file GSTR-1 or final sales return of a particular month by the 10th day of the succeeding month. For businesses with a turnover up to 1.5 crore rupees, and who are required to file quarterly returns, the GSTR-1 giving details of outward supplies has to be filed by the last date of the subsequent month.

The CBIC has said that the due date for filing a quarterly return for the July-September period is 31 October, while for October-December, 2018, the period it is 31 January 2019.

Meanwhile, the government on Friday sought to remove ambiguity around goods and services Tax GST applicable on over a dozen products including fortified milk, petroleum gas, human blood plasma and fertilizers in a bid to avoid confusion and disputes.