RBI flags inflation stability in the NDA reigns amidst the increased GDP growth rate

Total Views |

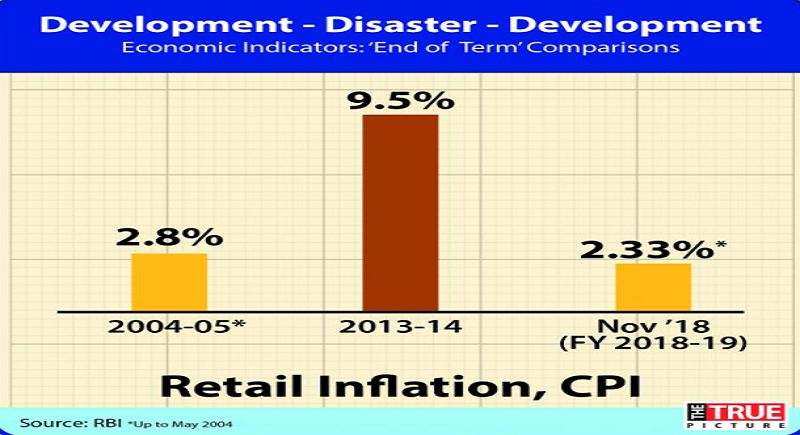

Pune, January 1: Economy is considered to be doing good if it maintains inflation around 3% with a GDP growth rate of about 7-8%. Today, most economists favour a low and steady rate of inflation. Central banks or other monetary authorities in most of the countries are tasked with keeping their inter-bank lending rates at low stable levels, normally to a target annual rate of about 2% to 3%.

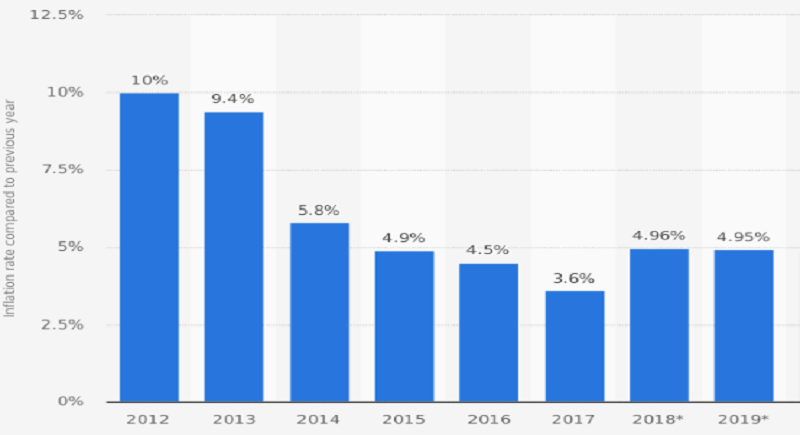

In India over the years, NDA governments have been able to bring Indian economy into that sweet spot. It is the annual consumer inflation in India that declined to 2.33 per cent in November of 2018 from an upwardly revised 3.38 per cent in October and below market expectations of 2.8 per cent. It is the lowest inflation rate since June of 2017 as food prices fell the most since the series began in 2012.

However, the Reserve Bank of India revised down its inflation forecasts to 2.7 percent-3.2 per cent for the period Oct 2018, amidst the lower food and fuel prices. Inflation Rate in India averaged 6.37 per cent from 2012 until 2018, reaching an all time high of 12.17 per cent in November of 2013 and a record low of 1.54 per cent in June of 2017.

Under both NDA governments of Atal Bihari Vajpayee and Narendra Modi, retail inflation has remained low ranging between 2-3%. The UPA governments in anyway have not been able to control the inflation during their terms, the base being higher inflation with lower GDP growth rate signifying bad economical attributes.

Inflation is usually defined as an increase in the overall price level. The term does not apply to the price level of just one good, but rather to how prices are doing overall. Whereas, the Consumer Price Index represents prices paid by consumers (or households). The inflation rate at the national level is computed by dividing the difference of CPIs in two years by the previous year’s CPI and then multiplying by 100.

The RBI has projected a retail inflation rate of 4.8 per cent by June 2019, slightly lower than its August forecast of 5.0 per cent. “For the one year ahead horizon, expectations were broadly unchanged. In quantitative terms also, three months ahead median inflation expectations eased by 40 basis points (bps) from the September 2018 round; however, their one year ahead expectations remained unchanged”, said the official statement in relation.