Here is what you can expect from the year's last budget on the face of elections heading..!

Total Views |

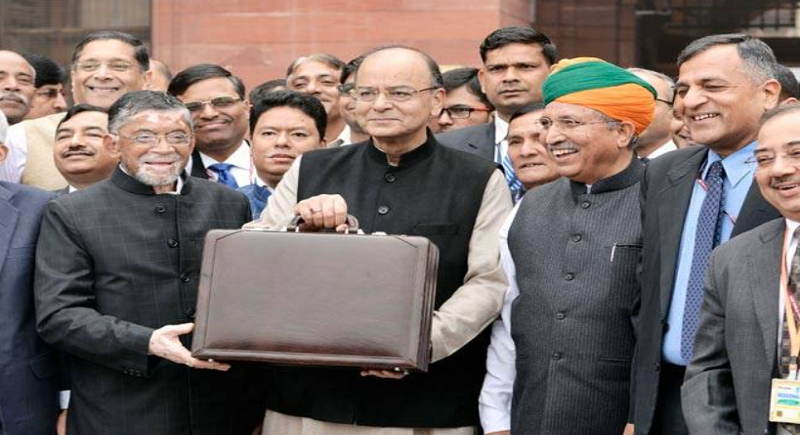

New Delhi, January 14: In the cornering hours of the Union Budget 2019, scheduled on 1st of February, Finance Minister is set to increase the pressure to fulfill the Modi government’s promise to bring corporate tax down to 25 per cent for all the companies. It is now that the analysts and the finance experts have started expecting and projecting the geared budget at the Centre.

The Corporate tax rates are too high in India. World over, corporate tax rates are lower than the personal income tax rate so that funds can flow into the corporate sector,” said Ved Jain the past president of Institute of Chartered Accounts(ICAI).

Meanwhile V Lakshmi Kumaran, managing partner of Lakshmikumaran and Sridharan said that reducing the corporate tax rate even by 5%, coupled with the certainty in the manner of enforcement, will result in quantum jump in GDP and will act as a catalyst to millions of people in India to have better living standards.

The Federation of Indian Chambers of Commerce & Industry (FICCI) project that 30 per cent Income tax rates should be applied to individual earning over Rs 20 lakh per annum. Currently, individuals aged 60 years, with an annual income of over Rs 10,00,000 need to pay the 30 per cent income tax. Apart from this, the FICCI has suggested that the income tax exemption should be raised to Rs 200 per meal from the existing limit of Rs 50. Rationalisation of tax structure, whether individual or on the corporate front, has been a long-standing demand of industry bodies.

“The better way to play would be to focus on the consumer sector, especially companies related to low ticket discretionary consumer items. Besides, rural push would be there. We expect some kind of a money flow into the hands of the farmers because of the farmer distress and one could play some of the rural themes purely from a short-term perspective,” Mahesh Patil of Aditya Birla Sun Life Mutual Fund expects.

AK Prabhakar of IDFC Securities believes that the government has limited room for making any big announcement, as there is a big shortfall in GST revenues. If the government announces higher-than-expected sops deemed populist, the market might not take them positively as fiscal stability will go for a toss, Prabhakar said.

“The government will look at innovative ways to do. There is not much headroom for the government to actually go and spend money. This vote-on-account thus be a non-even. It will be a steady thing and not rocking the boat," Sunil Subramaniam, MD & CEO at Sundaram Mutual Fund reported.

Despite of these pre-budget reports and expectations, it will be a novel concern to note the changes in the last budget of the year proposed to be presented by the Finance Minister in the first week of February.