Currency Depreciation, the silent game changer of the Economy..!

Total Views |

Pune, January 7: Shadowing the domestic and international trends concerning the value of Indian Rupee in the market, the value has reached new altitudes of 69.90 against a single dollar of US currency. Although this being less important directly affecting the consumers, it acts as the game changer of the economy. Conceptually, currency depreciation is a fall in the value of a currency in a floating exchange rate system.

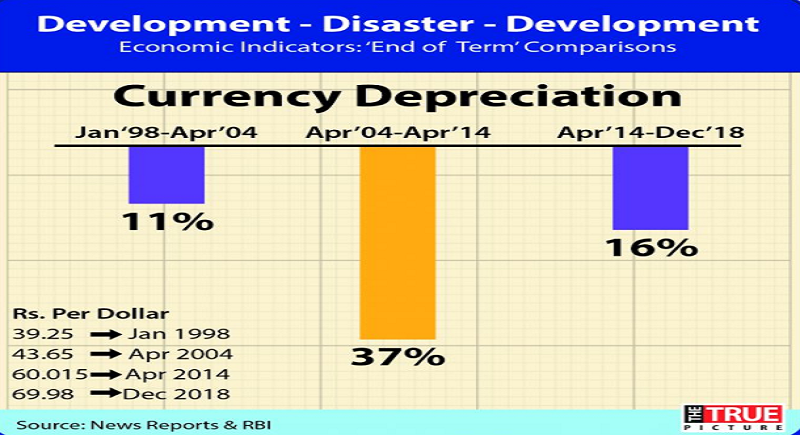

Depreciation in the value of Rupee against the US Dollar was another offensive move amongst others launched against the Modi government. Ironically, it is under the Congress-led UPA governments that rupee depreciated the most as can be seen from the graph, citing the data from the Reserve Bank of India. In the NDA reign under Vajpayee, the value of rupee against dollar was 39.25, whereas the same under the directive today measures around 70.

Usually, when a country's currency appreciates in relation to foreign currencies, foreign goods become cheaper in the domestic market creating downward pressure on domestic prices. In contrast, the prices of domestic goods paid by foreigners go up, which tends to decrease foreign demand for domestic products. A depreciation of the home currency has the opposite effects.

In addition, depreciation of a currency tends to beneficially affect a country’s balance of trade by improving the competiveness of domestic goods in foreign markets while making foreign goods less competitive in the domestic market by becoming more expensive. The reason for this can constitute fluctuations in economic fundamentals, interest rate differentials, political instability, risk aversion among investors and many more.

In the international capital market, a change in a currency’s value may give raise to a foreign exchange gain or loss. The appreciation of the domestic currency raises the value of financial instruments denominated in that currency, while there is an adverse impact on debt instruments.

Countries with weak economic fundamentals such as chronic current account deficit and high rates of inflation generally have depreciating currencies. Currency depreciation, if orderly and gradual, improves a nation’s export competitiveness and may improve it’s trade deficit over time as explained above.

But on the other side of the table, abrupt and sizeable currency depreciation tend to scare foreign investors who fear the currency may fall further, leading to excess pulling portfolio investments out of the country. This situation ultimately surges putting further downward pressure on the currency.

Even though some temporary benefits are there by currency depreciation, it is inadequate for the country’s economy. At the time of Indian Independence, a rupee was coequal to dollar citing the development graphs at that time. Today, the Government is expected to take some measures to appreciate the currency value to reach at the least of minimum cent lower which will result into the international price fluctuation trends and be the game changer again..!