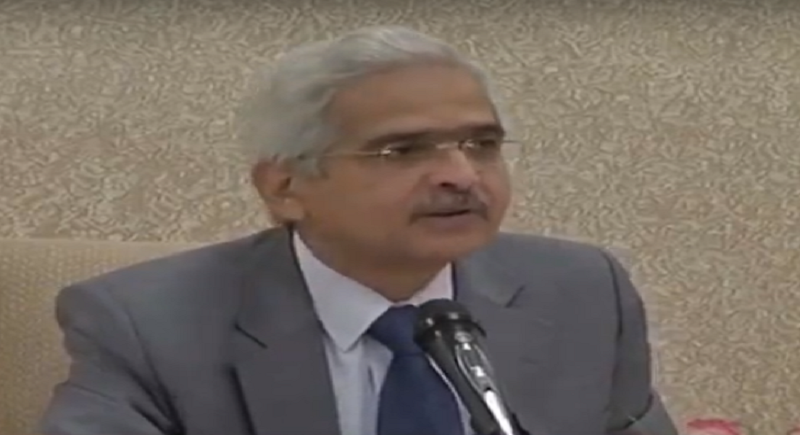

RBI focuses on health of Indian banks and emerging NPAs; professes Shaktikanta Das

Total Views |

New Delhi, January 7: “States have to decide if they have the fiscal space for farm loan waivers. Any generalised write-off obviously has adverse impact on credit culture and future credit behaviour of borrowers.”, cleared the recently appointed RBI Governor today at a press conference in New Delhi.

“In the past month alone, three Indian states — Assam, Chhattisgarh and Madhya Pradesh — have announced schemes to waive farm loan. They join a growing list of state governments which have resorted to such waivers in the past two years.”, comments Das amidst Modi’s efforts to alleviate farm distress in the country.

Stressing over the NPA in the public sectors, Das continued to say, “The NPAs are being monitored on a daily basis. The health of India’s banks and managing their non-performing assets remains the main focus for the central bank”. The RBI is also in consultation with stakeholders to create a governance framework of public sector banks without putting impediments in the working of banks, he said.

Shaktikant Das met associations of the small and medium enterprises sector today to get their point of view on the restructuring announced. Das during the session, noted the demands made by MSMEs and asked the banks to look into viability of individual MSMEs. Also the banks have been asked to take it to their boards whether it's viable to restructure MSME loans.

The Reserve Bank of India said it will form an expert committee to identify the issues and propose long-term solutions for economic and financial sustainability of small businesses.

The panel will be headed by UK Sinha, former chairman of Securities and Exchange Board of India, according to a press statement published on the central bank’s website. The eight-member committee will also include government representatives, bankers and academicians.

The central bank, in its financial stability report released on Dec. 31 had highlighted the potential risks emerging from the MSME sector. The performance of public sector banks in the MSME sector lags private peers and non-bank lenders, according to the RBI’s report. The report said 20 percent of the exposure of public sector banks is to the lowest-rated MSMEs where the default risk is high.

Meanwhile, the governor said that the central bank has not taken a decision on the interim dividend payment yet. “While a lot of discussions taken place between the RBI and the government, no specific communication has taken place regarding this”, he added.

Economic Affairs Secretary Subhash Chandra Garg had informed the reporters in August that the RBI had transferred Rs 10,000 crore as interim dividend in March, and the government will receive the remaining amount this fiscal.