Government boosts Public Sector Banks by instilling Rs 83000 crores

Total Views |

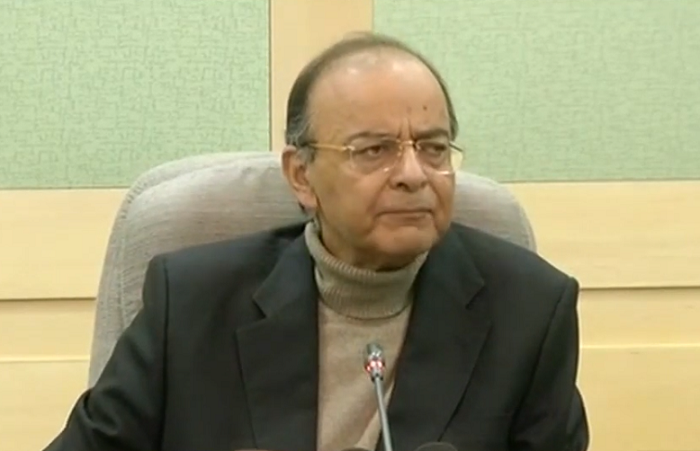

New Delhi, December 21: Finance Minister Arun Jaitley said that the Government will infuse Rs 83000 crore in the Public Sector banks in the next few months of the current fiscal yesterday. Earlier in the day the Government sought Parliament’s approval to infuse an additional Rs 41000 crore in state owned banks through the second batch of supplementary demands for grants. This is expected to increase a total recapitalisation in the current fiscal from Rs 65000 crore to Rs 1.06 lakh crore.

Jaitley said that the recapitalisation will enhance the lending capacity of state owned banks and help them come out of the RBI’s prompt corrective action framework. Jaitley also said that recognition of NPAs of the Public sector banks is complete and that reduction of bad loans have begun.

The move is aimed at lifting the better-performing PSU banks out of the Reserve Bank of India (RBI)'s Prompt Corrective Action (PCA) plan.

“Recognition of the NPAs a process which started in 2015 has made a considerable headway. High provisioning has been made by banks which has led to peaking of NPAs. After peaking in March 2018, gross NPAs with public sector banks declined by Rs. 23,860 crore in the first half of the current financial year (2018-19). The last quarter has shown improved performance, a downward slide in NPAs itself will now commence, which will lead to an increase in the lending capacity of banks," Mr Jaitley said.

“PSU banks have made a record recovery of Rs. 60,726 crore in the first half of this financial year. That is more than double the amount recovered over the corresponding period last year.”, he added.

In 2017, the government had announced a Rs. 2.11 lakh crore package for 20 state-run banks to aid them in meeting global regulatory capital requirements.

Financial Services Secretary Rajiv Kumar, while talking in relation said that four to five such banks could be taken out of the Prompt Corrective Action with the infusion of this capital. The inflated provision will help these banks achieve the 9 per cent capital to risk-weighted asset ratio, and the 6 per cent net non-performing assets (NPA) threshold requirement to aid them come out of the PCA plan.

Additionally, the enhanced provision is aimed at helping banks meet regulatory capital norms, strengthening amalgamating banks by providing both regulatory and growth capital, and facilitating non-PCA banks that are in breach of some PCA thresholds to not breach them.