Concerning economic stability at priority, Finance Commission suits up to meet RBI and Financial institutions

Total Views |

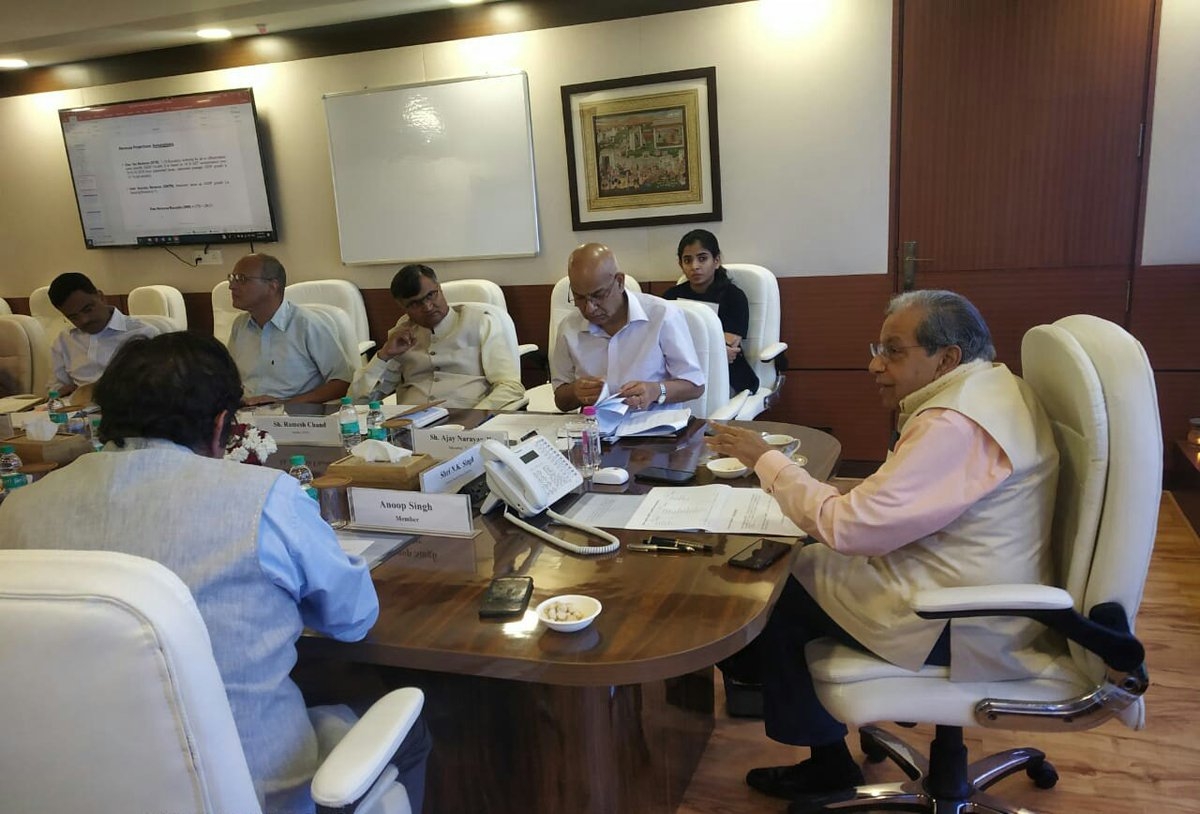

Mumbai, May 7: Viewing to discuss the key parameters of macro economic assumptions central to the economic stability in India, the 15th Finance Commission is set to visit the financial capital on 8th and 9th of May. The Commission will be meeting the RBI and other Banks and Financial Institutions where modalities for borrowing costs are to be deep discoursed.

The two day visit is likely to be headed by the Commission Chairman N K Sing and the RBI Governor Shaktikanta Das. The meeting is to be attended by major banks sectors being, State Bank of India, Bank of Baroda, Bank of India, Bank of Maharashtra, Axis Bank Ltd., IDFC First Bank Ltd., IDBI Bank Limited along with others.

The Commission will also hold a detailed meeting with eminent economists to discuss the various Terms of Reference of the 15th Finance Commission. Besides the factors for the macro economic undertakings, the said meet is set to discuss the 5 major issues being:

1. Issues in quantifying contingent liabilities of States and off-budget transactions of States, and other issues of public financial management.

2. Requirements of recapitalisation of banks and their impact on the cost of borrowings of governments.

3. Views on possible debt trajectories of States and State-specific consolidation road map.

4. Possible scenarios of the Bimal Jalan Committee Report on surplus capital available with the RBI for transfer to the Government of India.

5. RBI’s own assessment of the dividends and surpluses that can be transferred to the Government of India during the award period of FCXV.

Ahead of the meeting with the Banks and Financial Institutions, the heads will be discussing about the Cost of borrowings of the Centre and the States during the award period and recapitalization of banks and their impact on the cost of borrowings of governments.