Decoding the 'Big Bank theory! Walking the $5 trillion path, Sitharaman timely makes a move to 12 from 27 PSBs

Total Views |

New Delhi, August 30: “What has been received from the RBI, the government will take a call how to use it”, said Finance Minister Nirmala Sitharaman referring to the major transfer of Rs 1.76 lakhs crore to the government, made by the RBI.

She was addressing a press conference in the national capital today where she set a final roadmap for the Public Sector Unit Banks, merging the total of 27 into 12. She further gave approximate numbers for the amount of capital that will be infused in state-run banks. “This capital infusion will be for growth and not for consolidation”, she said.

Capital Infusion Schedule :

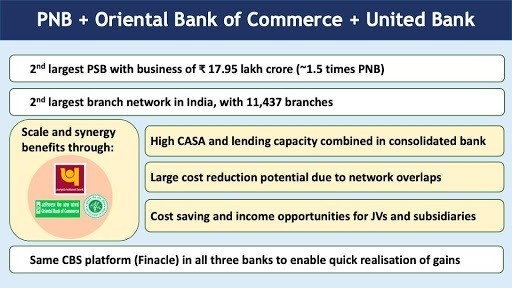

Punjab National Bank: Rs 16,000 crore

Union Bank of India: Rs 11,700 crore

Bank of Baroda: Rs 7,000 crore

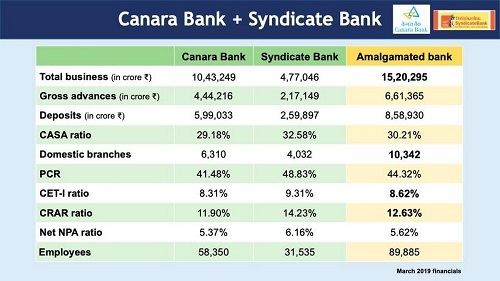

Canara Bank: Rs 6,500 crore

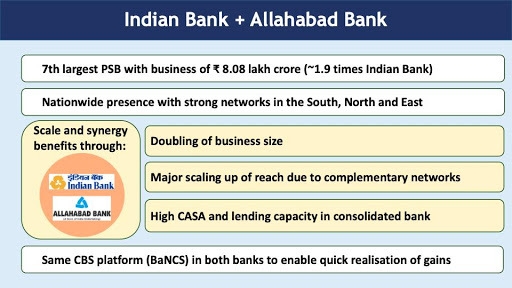

Indian Bank: Rs 2,500 crore

Indian Overseas Bank: Rs 3,800 crore

Central Bank of India: Rs 3,300 crore

UCO Bank: Rs 2,100 crore

United Bank: Rs 1,600 crore

Punjab & Sind Bank: Rs 750 crore

Meanwhile lauding the decision, NITI Aayog Chief Rajiv Kumar said that this was the right time to consolidate banks to enable them to make India a $5 trillion economy,

He also said that the alternate mechanism had given its approval for the mergers. “The bank’s boards will consider the proposals. Each bank will take the proposal to their respective boards and then the permission will be sought from the RBI. The merger will create six globally competitive banks”, he added.

India will now have 12 public sector banks, being Punjab National Bank, Canara Bank, Union Bank of India, Indian Bank, State Bank of India, Bank of Baroda, Bank of India, Central Bank of India, Indian Overseas Bank, UCO Bank, Bank of Maharashtra, and Punjab and Sind Bank.