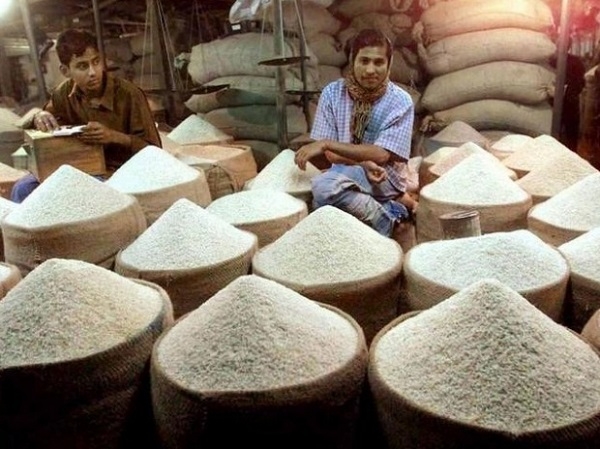

India's rice exports jump to record on Thai drought effects

Total Views |

New Delhi, October 09: India's rice exports in 2020 may rise by nearly 42 per cent from a year ago to record highs because of reduced shipments from rival exporters and a depreciating rupee, industry officials said this week. Higher shipments from India, the world's biggest rice exporter, could cap global prices, reduce the country's bulging inventories and limit Indian state stockpiler purchases from farmers.

India's rice exports could jump to 14 million tonnes in 2020, up from last year's 9.9 million tonnes, the lowest in eight years, said B.V. Krishna Rao, president of the Rice Exporters Association. "Thailand's shipments are falling due to the drought. Vietnam is struggling because of lower crop. That share is naturally coming to India," Rao said.

Thailand, the world's second-largest rice exporter, suffered through a drought earlier this year that has affected the rice crop. Shipments in 2020 could fall to 6.5 million tonnes, the lowest in 20 years. Vietnam, the third-biggest global exporter, has contended with low water levels in the Mekong River Delta, the country's main rice growing region, that has limited supply. India mainly exports non-basmati rice to Bangladesh, Nepal, Benin and Senegal, and premium basmati rice to Iran, Saudi Arabia and Iraq.

India's rice shipments in 2020 will rise because of robust demand for non-basmati rice from African countries. Basmati rice demand is more-or-less stable, but in non-basmati we have seen a huge surge in demand due to attractive prices. India's non-basmati rice exports may double from a year ago to 9.5 million tonnes, while basmati rice exports would remain stable around 4.5 million tonnes

India was offering 5 per cent broken parboiled rice at $380 per tonne on a free-on-board basis, while Thailand was offering the same grade at $490 per tonne. Indian exporters meanwhile have offered rice at lower prices at a time when global prices have jumped on limited supplies because of the rupee's depreciation. Also, the higher exports should cut into Indian inventories and limit government purchases from farmers at minimum support prices.