RBI governor highlights measures taken to support economy in COVID-19 crisis; Read More

Total Views |

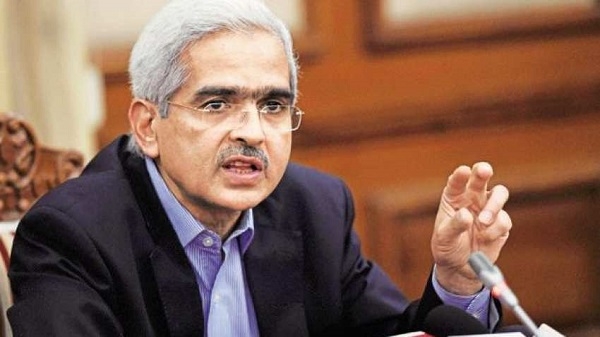

New Delhi, July 11: Throwing light on the key aspects to protect the Indian economy amid the coronavirus crisis, RBI governor Shaktikanta Das on Saturday said that RBI has taken several measures to protect the country's financial system and support the economy in the current crisis. Addressing the 7th SBI Banking & Economics Conclave, through a video call, he said that the topmost priority for RBI is growth and financial stability.

The governor assured that the Indian economy has shown signs of getting back to normalcy. He also said that equal priority has to be given to the aspect of financial stability and redemption pressure on NBFCs and mutual funds needs to be monitored.

Keynote address by RBI Governor in SBI Conclave https://t.co/7HQJBV1cKj

— ReserveBankOfIndia (@RBI) July 11, 2020

RBI governor Shaktikanta Das highlighted aspects of key measures taken by the central bank amid coronavirus pandemic

- Monetary policy measures: RBI already had an "accommodative" stance before the onset of COVID-19.

- Since February 2019, RBI has cut-rate by 135 basis points.

- Both conventional and unconventional liquidity measures were taken to boost market confidence, ease liquidity stress.

- RBI has announced liquidity measures worth Rs 9.57 lakh crore since February, equivalent to 4.5% of GDP.

RBI is engaged with all stakeholders for resolution for Punjab and Maharashtra Cooperative (PMC) Bank. "From February 2019 onwards, on a cumulative basis, we had cut t the repo rate by 135 basis points till the onset of Covid-19. That was done mainly to tackle the slowdown in growth which was visible at that time and we had elaborately touched upon its in our MPC Resolutions," he said.

Speaking about the pandemic, he stated, "The coronavirus pandemic represents so far the biggest test of robustness & resilience of our economic & financial system. It has dented the existing world order, global value chains, and capital movements across the globe.

Further, he said, "Coronavirus is the worst health & economic crisis in the last 100 years with unprecedented negative consequences for output, jobs & well being." However, he said that amid this crisis, "RBI has strengthened its offsite surveillance mechanism to identify emerging risks."

He said that the pandemic will result in high NPAs (non-performing assets) and capital erosion and the post containment of COVID, very careful trajectory has to be followed.