Govt waives off import duty on COVID-19 related supplies including Mucormycosis

Total Views |

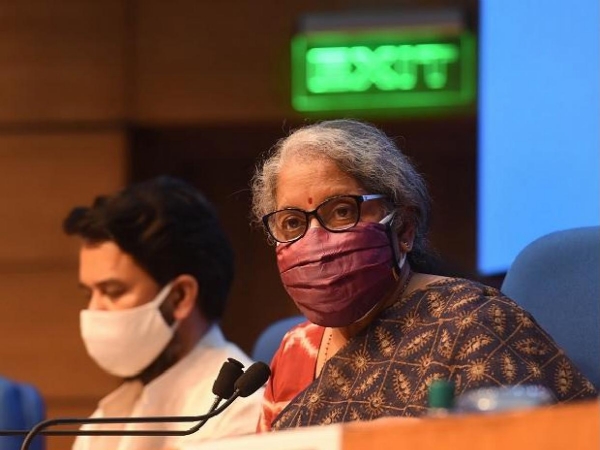

New Delhi, May 29:Amid when the country is going through a medical crisis, 43rd GST Council chaired by FinMin Nirmala Sitharaman on Friday (28 May) exempted the IGST on import of free COVID-related supplies included till 31 August. FinMin announced the decision in the press conference saying that in view of rising Black Fungus cases, the Council has also included Amphotericin-B, in the exemptions list. Amphotericin B is required for treating Mucormycosis or Black Fungus infection.

Sitaraman said, "Adhoc exemptions have been given for COVID-related equipment. The council has decided to exempt the import of many of these items with an exemption extended to August 31, 2021." According to the Ministry, IGST exemption was applicable only when these goods were imported 'free of cost' for free distribution. It should be noted that these goods are already exempted from Basic Customs duty

Moreover, the Finance Minister makes it clear that the taxes on COVID-19 vaccines and medical supplies will remain unchanged and a decision will be taken on it by June 8. In the statement, Ministry said, "Further relief in the individual item of COVID-19 after Group of Ministers (GoM) submits report on 8th June 2021. As regards individual items, it was decided to constitute a Group of Ministers (GoM) to go into the need for further relief to COVID-19 related individual items immediately. The GOM shall give its report by 08.06.2021."

Moreover, Finance Minister also informed that the govt had paid 4,500 crore rupees to two vaccine manufacturers as advance payment. She added that the country is engaging with suppliers and manufacturers including Japan, and European Union for vaccines. She said supply will increase in the coming months.

Apart from this government has also given relief to the small taxpayers and announced an amnesty scheme with reduced late free for small and medium GST taxpayers. "One of the biggest decisions is the reduction of the compliance burden of small taxpayers & medium-sized taxpayers. Late fee, Amnesty-related matters are also decided upon. To provide relief to small taxpayers, an Amnesty scheme recommended for reducing late fee payable in these cases," the FM said.

It should be noted that this was the first meeting of the GST Council in the financial year 2021-22. The council’s last meeting was held in October last year.

.

.