‘No new change’: Govt issues clarification on new tax regime | 6 key points

Total Views |

New Delhi, April 1: The Finance Ministry has issued a clarification amidst misleading information being circulated on social media platforms regarding the new tax regime. It clarified that beginning April 1, 2024 (FY 24-25), there will be no new change in the ongoing tax regimes.

Notably, in the interim budget for 2024-25, Finance Minister Nirmala Sitharaman did not announced any changes in the tax structure, whether direct or indirect. Therefore, the income tax slabs for both the new and old regimes remain unchanged from those announced in the Union Budget for 2023-24.

“It has come to notice that misleading information related to the new tax regime is being spread on some social media platforms,” the ministry said.

It added the points of clarification given below-

- There is no new change which is coming in from 01.04.2024.

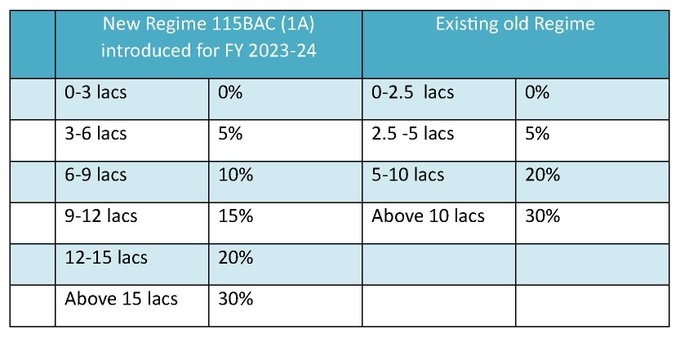

- The new tax regime under section 115BAC(1A) was introduced in the Finance Act 2023, as compared to the existing old regime (without exemptions)

- The new tax regime is applicable for persons other than companies and firms, is applicable as a default regime from the financial year 2023-24 and the assessment year corresponding to this is AY 2024-25.

- Under the new tax regime, the tax rates are significantly lower, though the benefit of various exemptions and deductions (other than standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) is not available, as in the old regime.

- The new tax regime is the default tax regime, however, taxpayers can choose the tax regime (old or new) that they think is beneficial to them.

- Option for opting out from the new tax regime is available till filing of return for the AY 2024-25. Eligible persons without any business income will have the option to choose the regime for each financial year. So, they can choose a new tax regime in one financial year and old tax regime in another year and vice versa.