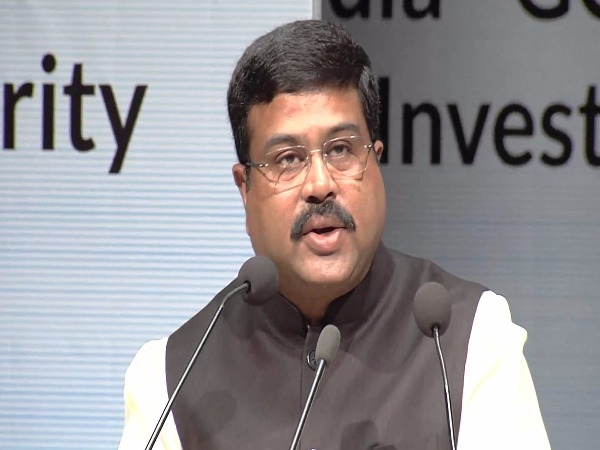

Dharmendra Pradhan wants Petroleum products to come under GST

Total Views |

Mumbai, September 18: Petroleum Minister Dharmendra Pradhan’s request to finance ministry on including petroleum products in the orbit of GST has raised many questions. The government will have to look into this matter and will have to think on it.

Market spectators feel that if the Government will go ahead with Pradhan’s proposal then outrageous fall in fuel price is expected. Depending on the GST slab, Petroleum products will get cheaper by 22-50%.

If we assume the changes in petrol price in Mumbai, petrol now sells for Rs 79.48, if the 12% of GST slab will be applicable on petrol then the price will come down to Rs 38, Rs. 40.05 at 18 percent rate and Rs. 43.44 at 22 percent rate. And for 28 percent slab, petrol could be sold at Rs. 50.91. Similarly, Diesel sells for Rs 62.37 in Mumbai. It will be sold at Rs 36.65 at 12% GST rate, at 18% it will be Rs. 38.61, Rs 41.88 at 28 percent and Rs 49.98 for 28 percent slab.

The state government of Maharashtra applies VAT of 32.04% + Rs 2 as Sales Tax + Rs 1.5 Add-on VAT. While the centre charges excise duty of Rs.21.48 on petrol.

In Delhi, VAT varies from State to State - 27% on Petrol & 16.75% on Diesel + 25p as Pollution Cess with Surcharge and excise Charged by Central Government is Rs. 21.48 / Litre on Petrol and Rs. 17.33 / Litre on Diesel.