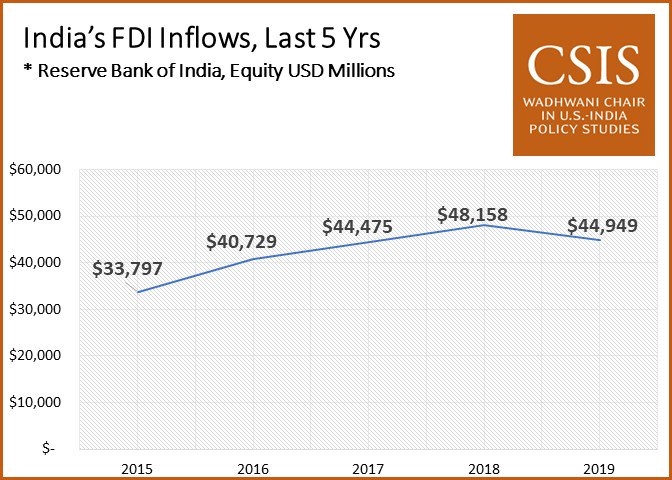

India's FDI Inflows during the five fiscal years of the Modi Govt hit to $42 bn

Total Views |

Mumbai, June 13: Swelling with strong inflows in manufacturing, communication, financial services and cross-border merger-acquisition activities, India has turned out to be the sub region’s largest recipient receiving foreign direct investments worth $42 billion in 2018.

"Investment in India – the sub region's largest recipient – rose by 6% to$42 billion with strong inflows in manufacturing, communication and financial services", said the United Nations trade report adding that the prospects for FDI inflows into South Asia are largely determined by expectations of growing investment into India.

According to the report, it is in South Asia that the FDI inflows have increased by 3.5% to $54 billion. So, India has attracted over 77% of the total foreign direct investments that have ultimately landed up to the South Asian region.

The growth in India in cross-border merger and acquisitions (M&As) grew to $33 billion in 2018 from $23 billion a year ago, primarily due to transactions in retail trade, which includes e-commerce and telecommunication.

Among others in the South Asian region, FDI flows to Bangladesh and Sri Lanka rose to a record level, to $3.6 billion and USD 1.6 billion, respectively, while Pakistan witnessed a 27% decline in investment to USD 2.4 billion, the report read.

“Many countries adopted policy measures to promote and facilitate investment with India amending the model concession agreement on public-private partnerships in the port sector”, UNCTAD said, adding the country liberalised rules on inward investment in several industries, including single-brand retail trading, airlines and power exchanges.

The report also highlighted that of the 5,400 special economic zones (SEZs) in the world, more than 4,000 are in developing countries in Asia. In the developing countries in Asia, China topped the list at 2,543 such zones, followed by Philippines (528), India (373) Turkey (102), Thailand (74) Korea (47), Malaysia (45) among others.

"The number of SEZs in South Asia is set to increase substantially in the coming years. India has over 200 new zones in the pipeline, although growth may lose momentum now that permits for a substantial number of zones have been retracted", the report signed off.