#4YearsOfGST- 4 years of simple, transparent and technology-driven tax regime

30 Jun 2021 11:16:14

Four years ago, the PM Modi led government implemented one of the most ambitious taxation reforms, making ‘One Nation, One Tax’ framework a reality which the years have ushered in a new era of ease in taxation, ensuring greater compliance, transparency and digitisation.

Marking 4 years of GST, the Ministry of Finance in a series of tweet said, "it is now widely acknowledged that GST is both consumer and taxpayer-friendly. While high tax rates of the pre-GST era acted as a disincentive to paying tax, the lower rates under GST helped to increase tax compliance. More than 66 crore GST returns have been filed so far".

"Now, Businesses with an annual turnover of up to Rs 40 lakh are GST exempt (for goods). Initially, this limit was Rs 20 lakh. Additionally, those with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1% tax (for goods). For services, Businesses with turnover upto Rs 20 lakh in a year are GST exempt. A service provider having turnover upto Rs 50 lakh in a year can opt for composition scheme for services and pay only 6% tax", it added.

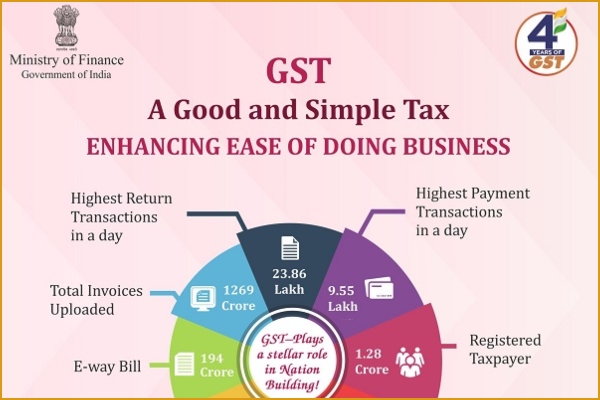

Meanwhile Anurag Thakur, MoS Finance and Corporate Affairs said that GST has significantly eased one of the most complex indirect tax systems in the world. "A company looking to do business in every state had to make as many as 495 different submissions. Under GST, that number has reduced to just 12. The multiple markets across India, with each state charging a different rate of tax, led to great inefficiencies and costs of compliance. Under GST, compliance has been improving steadily, with around 1.3 Crore taxpayers registered", he added..

.

.