Lessons From the East XII: Weak Currency, Strong Stock markets, Or Strong Currency, Weak Stock Markets! Which one & Why?

19 Oct 2022 09:54:44

When one observes things, objects, or broaches any subject with limited data or on a standalone basis, it’s abstract and the mind draws conclusions based on Negativity Bias believing one is worse off.

However when statistics and data from converging broader contours, from other regions, from other geographies are brought in, then it makes the mind re-think rationally about the changes that are occurring in the world.

Analyzing such data, and going deep into the reasoning behind it facilitates one to believe that despite the hullabaloo, the chaos, and the turmoil around the world, Bharat is not only in a comfortable position but today stands in a pole position.

This note will cover two basic fundamental questions that are revolving today in everyone’s mind.

Why is the Stock market in Bharat (India) going up, when the equity markets globally are witnessing severe weakness?

If the stock markets in Bharat are going up on account of a strong underlying economy as has been stated in my previous notes then why is the Indian Rupee weakening?

Let’s begin with the second question first. Why is the Indian Rupee weakening?

1. Collapse across Asset classes & the Energy Enigma

Rarely does it happen, when all asset classes witness a fall simultaneously?

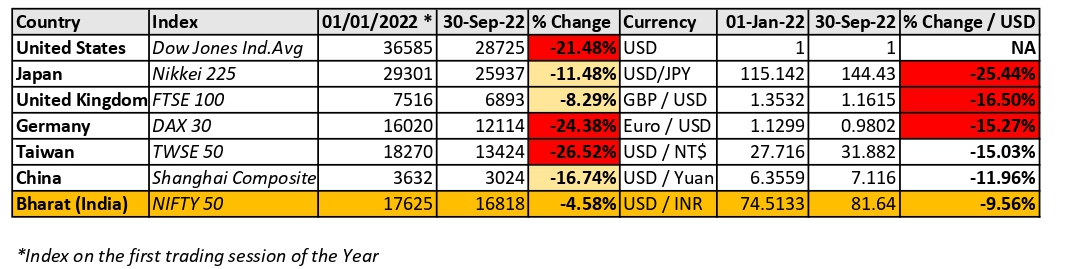

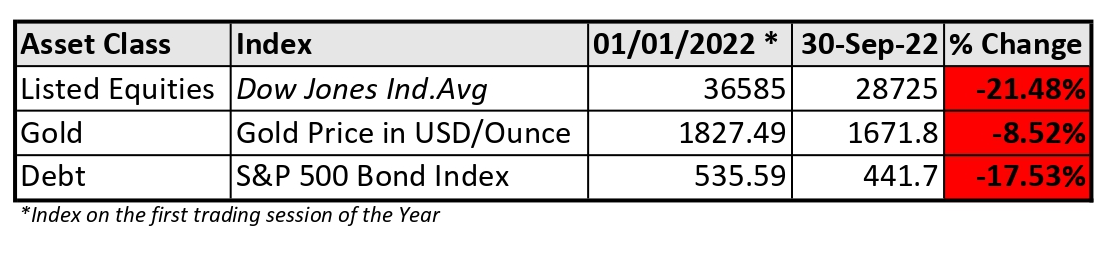

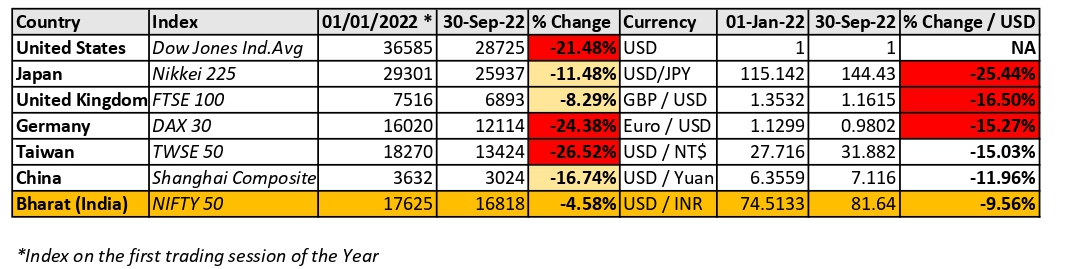

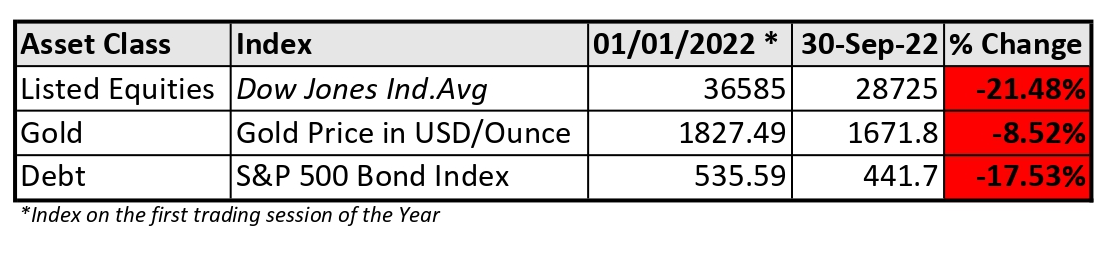

Debt, Equity, and Gold has seen cuts, deep cuts in this calendar year. The above table shows how asset classes have got hammered all across.

Reason for the fall

The excessive money supply in the system on account of covid, disruption in supply chains, and a surge in demand post-covid-era led to a rise in inflation, a rise in interest rates to curb a rise in inflation, rise in interest rates, pushing the borrowing costs up thus creating a de-leveraging trade across asset classes globally. To top it all the Russian-Ukraine war with a dangling nuclear threat and food supply as well as fertilizer shortage to make things worse.

Thus global institutional investors and fund managers have rushed toward safety and protection.

The US Dollar signifies protection as the demand for the US dollar is consistent on account of energy contract settlement. The Global Oil and Gas market is ~ 6 trillion in size. Over 85% of the market is settled in the US Dollar and thus the demand for energy keeps the demand for the USD buoyant.

Why Crude is settled in the USD and the history behind it is covered in this note

Also since Crude and gas are settled in USD, hence most energy-importing nations also need to maintain reserve or surplus forex reserves in USD to ensure that the importing nations are not hit with double-edged swords of USD movement and oil price movement. This constant demand to maintain forex reserves gives stability to the USD and creates a perpetual demand for the USD. Nearly 60% of the total rainy day reserves across central banks globally are maintained in US dollar or dollar-denominated assets, thus making the US dollar resilient.

Efficient Systems, market making, and ease of transaction driven by tech have made the US dollar to be the most traded currency in the world by an enormous lead with 44.14% (nearly half of all currency trades involving the USD) in value terms with Euro trailing behind with 16.14%.

According to the Bank for International Settlements, the dollar-denominated credit to non-banks outside the US amounts to around $12 trillion. The next in line is in Euro–denominated credit which stands at ~ 3.8 trillion USD.

Since loans have been extended in USD and thus countries and companies need to pay back in the USD leading to heightened demand for the USD.

The USD remains a Vehicle Currency as well. In other words, most international currency dealers first convert the local currency into the USD and then convert the USD into the currency as needed. In other words, the US dollar facilitates the currency exchange, thus intrinsically creating more requirements for the USD.

Bharat and RBI both have been pushing for rupee-settled trade so that the need for USD is reduced, but it's still some time away.

3. The Big Dollar Bait

The biggest conundrum with the dollar is the vested interest of global investors and their alignment with the US Dollar.

According to IMF data, the US financial obligations, liabilities, and debt that the US government, US corporations, and US nationals owe to the rest of the world is ~ 53 trillion USD (to put things in perspective, how big is 53 trillion USD, the total size of the world economy as of 2021 stood at USD 94 trillion).

This debt or obligation is denominated in US dollars. Thus if the US Dollar value plunges the assets or the net worth of the rest of the investors across the globe will also nosedive. Thus keeping the US Dollar buoyant is good economics for large institutions and investors present outside the US, spread across the world.

Similarly, US Investors own ~ 35 trillion USD of foreign assets denominated in foreign currency completely. For these US investors if the dollar depreciates they are well off or better off.

On a net basis, though the United States owes to the rest of the world, the rest of the world has an alignment of interest to keep the US dollar strong.

Shifting gears to our first question, why are Indian stock markets or listed equities witnessing buoyancy during present uncertain times?

1. Rise of Retail & Financialization of Savings

Whilst India’s economy started marching forward at a rapid pace only three decades back, it has achieved major milestones in the recent decade to become the fifth largest economy in the world, poised to be the third largest in a decade.

Government reforms like demonetization, GST implementation, and financial inclusion policies like Jan Dhan and PAN Aadhar linkages, Direct Benefit Transfer of subsidies have not only capacitated a jump in discretionary demand but expedited the pace of financialization of savings as well. Covid accelerated this journey of savings of households and corporations from physical assets to financial assets and technology democratized financial education and eased the execution.

Result of which FIIs who once used to control the destiny of Indian stock markets have been shifted out with power migrating into the hands of the Indian Public.

A decade back in FY12, the total number of Demat accounts Indians held stood at ~19.9 million. Over a decade later in Aug 2022, that number stood at 100 million +, registering a five-fold jump in ten years.

Bharat's real GDP grew by 13.5% driven by investments, consumption, and manufacturing. This makes Bharat the growth engine for the world, racing ahead of other major economies in the world and making them look at Bharat seriously with an underlying thought of "TOO BIG TO IGNORE".

As stated above, the democratization of education has taught Small investors that Patience Pays and Volatility is a Friend and not a Foe. Thus despite extreme ups and downs during covid and the Russian-Ukraine conflict period, the retail money came full throttle and remained patient.

Retail money entering Indian equities through SIP or Systematic Investment Plan of Mutual fund. The monthly SIP flows into the markets via the mutual fund route have been between INR 12000 Crores to 13000 Crores. Just 6 years back, this number stood at 3500 Crores, a four-fold growth in six years.

2. FOMO in FPIs

In 2008, during the great financial crisis, FIIs (Foreign Institutional Investors) then and now popularly known as FPIs (Foreign Portfolio Investors) sold closer to 13.1 billion USD in listed equities in India and Nifty 50 corrected from 6144 at the beginning of 2008 to close at 2959 on the last trading day of 2008. A whopping loss of 52%.

In 2022, from Jan 2022 to June 2022, FIIs have been net sellers every single month. For these six months, FIIs sold ~ 28 billion dollar worth of listed equities in India. Despite this selling, the Nifty corrected by ~10%.

Domestic institutions now are flushed with retail money, retail savings, and retail money bought when FPIs sold.

FPIs have realized that Bharat will remain the fastest or second fasted growing economy with favorable demographics, a rising middle class, technology-oriented youth over the forthcoming decade. Thus exiting from Indian equities is a double whammy.

When FIIs sell, they crack the price themselves, and thus the final realization for them in the USD on account of impact costs is low comparatively. DIIs (Domestic Institutional Investors), HNIs, and domestic retail investors are buying consistently and they take the markets up slowly and gradually. When FPIs come back, to buy equities again, they are forced to buy at a higher price on account of volumes as well as buoyant flows from domestic investors and upward market movement led by domestic money.

Unfortunately, FPIs are caught in the Cross cycle of Selling Cheap and Buying Expensive, costing dearly to them.

In Summary, Bharat is a two-cylinder economy with young demographically favorable consumption on one side and manufacturing with Make in India, Make for India and make for the World on the other side. This is what driving the Indian Equities.

Reserve currency is a tight-wired system created by the United States to ensure that hegemony of the Dollar remains so that excesses of the US government and behemoth consumption by the US nationals can be funded by the rest of the world.

How long can this system sustain is anyone’s guess. Those who opposed or stood against, this system till now have fallen flat on their faces, but as an intelligent man said, "time is a big leveler", but till then, the US Dollar will continue to dominate the world.

However when statistics and data from converging broader contours, from other regions, from other geographies are brought in, then it makes the mind re-think rationally about the changes that are occurring in the world.

Analyzing such data, and going deep into the reasoning behind it facilitates one to believe that despite the hullabaloo, the chaos, and the turmoil around the world, Bharat is not only in a comfortable position but today stands in a pole position.

This note will cover two basic fundamental questions that are revolving today in everyone’s mind.

Why is the Stock market in Bharat (India) going up, when the equity markets globally are witnessing severe weakness?

If the stock markets in Bharat are going up on account of a strong underlying economy as has been stated in my previous notes then why is the Indian Rupee weakening?

Let’s begin with the second question first. Why is the Indian Rupee weakening?

1. Collapse across Asset classes & the Energy Enigma

Rarely does it happen, when all asset classes witness a fall simultaneously?

Debt, Equity, and Gold has seen cuts, deep cuts in this calendar year. The above table shows how asset classes have got hammered all across.

Reason for the fall

The excessive money supply in the system on account of covid, disruption in supply chains, and a surge in demand post-covid-era led to a rise in inflation, a rise in interest rates to curb a rise in inflation, rise in interest rates, pushing the borrowing costs up thus creating a de-leveraging trade across asset classes globally. To top it all the Russian-Ukraine war with a dangling nuclear threat and food supply as well as fertilizer shortage to make things worse.

Thus global institutional investors and fund managers have rushed toward safety and protection.

The US Dollar signifies protection as the demand for the US dollar is consistent on account of energy contract settlement. The Global Oil and Gas market is ~ 6 trillion in size. Over 85% of the market is settled in the US Dollar and thus the demand for energy keeps the demand for the USD buoyant.

Why Crude is settled in the USD and the history behind it is covered in this note

Also since Crude and gas are settled in USD, hence most energy-importing nations also need to maintain reserve or surplus forex reserves in USD to ensure that the importing nations are not hit with double-edged swords of USD movement and oil price movement. This constant demand to maintain forex reserves gives stability to the USD and creates a perpetual demand for the USD. Nearly 60% of the total rainy day reserves across central banks globally are maintained in US dollar or dollar-denominated assets, thus making the US dollar resilient.

2. Depth and breadth of the US Financial Markets

The US has the largest quantum of overall national debt amounting to USD 31.12 trillion. Since the US has large borrowing, it needs deep and advanced financial markets to ensure there is no liquidity/ impact cost while placing such large borrowings. Transparency and complete access to information enable the placement of debt with ease.Efficient Systems, market making, and ease of transaction driven by tech have made the US dollar to be the most traded currency in the world by an enormous lead with 44.14% (nearly half of all currency trades involving the USD) in value terms with Euro trailing behind with 16.14%.

According to the Bank for International Settlements, the dollar-denominated credit to non-banks outside the US amounts to around $12 trillion. The next in line is in Euro–denominated credit which stands at ~ 3.8 trillion USD.

Since loans have been extended in USD and thus countries and companies need to pay back in the USD leading to heightened demand for the USD.

The USD remains a Vehicle Currency as well. In other words, most international currency dealers first convert the local currency into the USD and then convert the USD into the currency as needed. In other words, the US dollar facilitates the currency exchange, thus intrinsically creating more requirements for the USD.

Bharat and RBI both have been pushing for rupee-settled trade so that the need for USD is reduced, but it's still some time away.

3. The Big Dollar Bait

The biggest conundrum with the dollar is the vested interest of global investors and their alignment with the US Dollar.

According to IMF data, the US financial obligations, liabilities, and debt that the US government, US corporations, and US nationals owe to the rest of the world is ~ 53 trillion USD (to put things in perspective, how big is 53 trillion USD, the total size of the world economy as of 2021 stood at USD 94 trillion).

This debt or obligation is denominated in US dollars. Thus if the US Dollar value plunges the assets or the net worth of the rest of the investors across the globe will also nosedive. Thus keeping the US Dollar buoyant is good economics for large institutions and investors present outside the US, spread across the world.

Similarly, US Investors own ~ 35 trillion USD of foreign assets denominated in foreign currency completely. For these US investors if the dollar depreciates they are well off or better off.

On a net basis, though the United States owes to the rest of the world, the rest of the world has an alignment of interest to keep the US dollar strong.

Shifting gears to our first question, why are Indian stock markets or listed equities witnessing buoyancy during present uncertain times?

1. Rise of Retail & Financialization of Savings

Whilst India’s economy started marching forward at a rapid pace only three decades back, it has achieved major milestones in the recent decade to become the fifth largest economy in the world, poised to be the third largest in a decade.

Government reforms like demonetization, GST implementation, and financial inclusion policies like Jan Dhan and PAN Aadhar linkages, Direct Benefit Transfer of subsidies have not only capacitated a jump in discretionary demand but expedited the pace of financialization of savings as well. Covid accelerated this journey of savings of households and corporations from physical assets to financial assets and technology democratized financial education and eased the execution.

Result of which FIIs who once used to control the destiny of Indian stock markets have been shifted out with power migrating into the hands of the Indian Public.

A decade back in FY12, the total number of Demat accounts Indians held stood at ~19.9 million. Over a decade later in Aug 2022, that number stood at 100 million +, registering a five-fold jump in ten years.

Bharat's real GDP grew by 13.5% driven by investments, consumption, and manufacturing. This makes Bharat the growth engine for the world, racing ahead of other major economies in the world and making them look at Bharat seriously with an underlying thought of "TOO BIG TO IGNORE".

As stated above, the democratization of education has taught Small investors that Patience Pays and Volatility is a Friend and not a Foe. Thus despite extreme ups and downs during covid and the Russian-Ukraine conflict period, the retail money came full throttle and remained patient.

Retail money entering Indian equities through SIP or Systematic Investment Plan of Mutual fund. The monthly SIP flows into the markets via the mutual fund route have been between INR 12000 Crores to 13000 Crores. Just 6 years back, this number stood at 3500 Crores, a four-fold growth in six years.

2. FOMO in FPIs

In 2008, during the great financial crisis, FIIs (Foreign Institutional Investors) then and now popularly known as FPIs (Foreign Portfolio Investors) sold closer to 13.1 billion USD in listed equities in India and Nifty 50 corrected from 6144 at the beginning of 2008 to close at 2959 on the last trading day of 2008. A whopping loss of 52%.

In 2022, from Jan 2022 to June 2022, FIIs have been net sellers every single month. For these six months, FIIs sold ~ 28 billion dollar worth of listed equities in India. Despite this selling, the Nifty corrected by ~10%.

Domestic institutions now are flushed with retail money, retail savings, and retail money bought when FPIs sold.

FPIs have realized that Bharat will remain the fastest or second fasted growing economy with favorable demographics, a rising middle class, technology-oriented youth over the forthcoming decade. Thus exiting from Indian equities is a double whammy.

When FIIs sell, they crack the price themselves, and thus the final realization for them in the USD on account of impact costs is low comparatively. DIIs (Domestic Institutional Investors), HNIs, and domestic retail investors are buying consistently and they take the markets up slowly and gradually. When FPIs come back, to buy equities again, they are forced to buy at a higher price on account of volumes as well as buoyant flows from domestic investors and upward market movement led by domestic money.

Unfortunately, FPIs are caught in the Cross cycle of Selling Cheap and Buying Expensive, costing dearly to them.

In Summary, Bharat is a two-cylinder economy with young demographically favorable consumption on one side and manufacturing with Make in India, Make for India and make for the World on the other side. This is what driving the Indian Equities.

Reserve currency is a tight-wired system created by the United States to ensure that hegemony of the Dollar remains so that excesses of the US government and behemoth consumption by the US nationals can be funded by the rest of the world.

How long can this system sustain is anyone’s guess. Those who opposed or stood against, this system till now have fallen flat on their faces, but as an intelligent man said, "time is a big leveler", but till then, the US Dollar will continue to dominate the world.