Dead economy's Amul reaches West!

11 Aug 2025 11:03:29

In a significant development, a global report has ranked India’s Amul among the top 10 global dairy brands, elevating it eight spots in the international food brand rankings to 14th place overall. With its brand value surging by 24% to USD 4.1 billion, Amul has strengthened its dominance in India and accelerated its global expansion. This comes at a time that reminds us of significant milestones that India’s dairy cooperative giant has achieved so far. It has evolved from a household brand into one of the world’s top dairy names.

Amul, a success story rooted in rural town

The success of Amul began in 1946 when, in a small town in Anand, Gujarat, local dairy farmers were exploited by a trade cartel and sought the advice of Sardar Vallabhbhai Patel. Guided by Patel and with the leadership of Morarji Desai and Tribhuvandas Patel, they rejected middlemen, went on a milk strike and formed their own cooperative “the Kaira District Co-operative Milk Producers’ Union.”

Starting with just two village societies and 247 litres of milk, it has united 3.6 million farmers across 18,600 villages. As India’s largest FMCG brand standing alongside Amazon and Flipkart in value rankings, Amul carries not just products but a legacy — a people’s movement that turned farmer empowerment into a global business success.

The statistics mentioned below highlight that every increase in capacity or turnover translates into better milk procurement prices, improved rural infrastructure, and stronger local economies.

For farmers, ₹90,000 crore in projected turnover is proof that the cooperative model can deliver global-scale success without sacrificing grassroots ownership.

Amul's global footprint and market entry

Amul’s journey from a small cooperative in Anand to a presence in more than 50 countries is a testament to the power of farmer-led enterprise. The world's largest farmer-owned dairy cooperative processes about 12 billion litres of milk annually. With a brand turnover exceeding $11 billion, Amul ranks as the eighth-largest milk processor globally, operating 112 dairy plants across India and handling 42 million litres of milk per day.

Its products are now available in the USA, the UAE, Australia, Singapore, across Africa. Recently (June 2025), the cooperative officially commenced the launch of fresh milk products in Spain, beginning with distribution in key cities such as Madrid and Barcelona. This expansion is not just about selling milk abroad — it is about ensuring that the value generated from India’s dairy sector flows back to the people who make it possible. Every litre of milk sold internationally represents the work of Indian farmers and feeds directly into India’s rural economy, sustaining livelihoods and empowering communities.

The estimated annual export revenue of ~USD 180 million represents thousands of villages where farmers get higher returns, co-operatives can invest in chilling plants, and veterinary services can be expanded — all funded by income earned in foreign markets.

The entry into Europe in 2025, beginning with Spain and soon expanding to Portugal, Germany, Italy, and Switzerland, is especially significant. Europe’s dairy industry, despite receiving billions in subsidies through the Common Agricultural Policy, is facing farmer protests, falling herd sizes, and a generational crisis in farming. In contrast, Amul’s model thrives without massive subsidies, returning 70–80% of the consumer price directly to farmers. By partnering with European cooperatives such as Spain’s COVAP, Amul is not depleting Indian resources — it is exporting the cooperative spirit and brand value built in India, while the returns from these sales come home to strengthen the Indian economy.

This means the milk sold in Madrid or Lisbon is not diverting food from Indian consumers — it is the surplus capacity of a system that has made India the world’s largest milk producer. It turns Indian farmers into global suppliers while ensuring that the wealth generated abroad is reinvested in better prices for producers, rural infrastructure, and cooperative growth.

Moreover, when speaking about Amul going global, the current trade scenario marks a strategic reversal. While the US actively seeks to “dump surplus milk”, non-veg milk into India’s protected market, Amul is expanding exports of Indian milk and dairy products to developed economies including the USA and EU. This proves India’s dairy sector is both self-sufficient and globally competitive, countering US claims of inefficiency and strengthening India’s trade negotiating position.

In response, PM Modi has firmly stated that India will “never compromise” on the interests of farmers, fishermen, and dairy producers, even at a “heavy price.” This reflects a deliberate choice to defend farmer welfare and national values over short-term trade concessions.

From Anand to the world

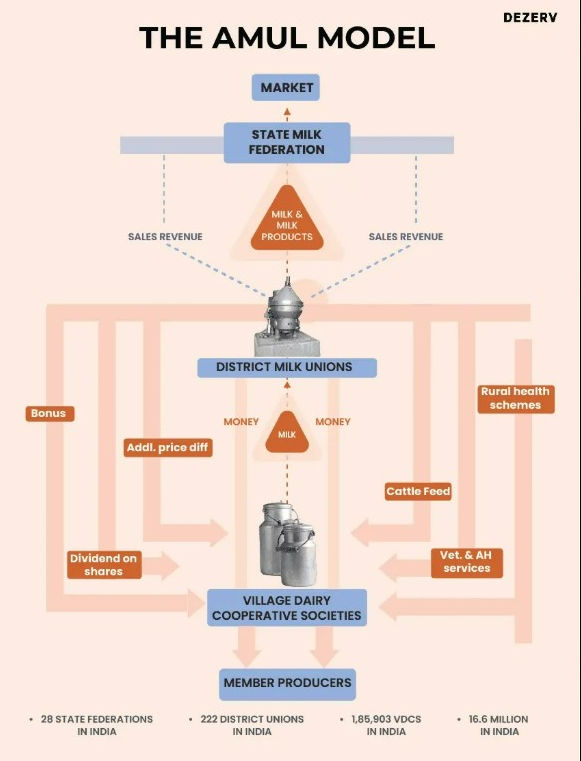

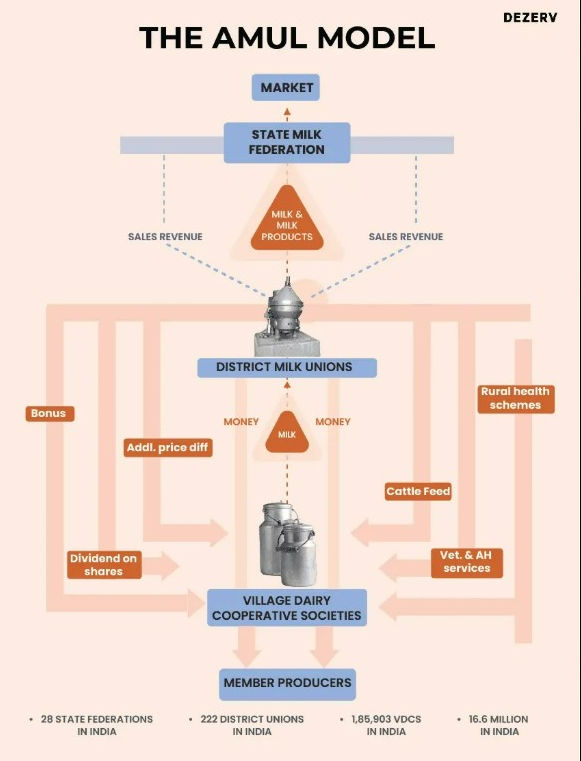

The Amul Model, a three-tiered cooperative structure, links farmers directly to consumers, eliminating middlemen and ensuring fair returns. At the village level, dairy cooperative societies collect milk from producers. These societies are federated under district milk unions, which handle processing, and the unions are further federated under state-level marketing federations responsible for branding and distribution.

In this model, milk producers control procurement, processing, and marketing, while professional managers run operations with efficiency and scale. This structure has enabled India to become the largest milk producer in the world. Today, more than 16 million farmers supply milk to 185,903 village dairy cooperative societies. Their milk is processed in 222 district cooperative milk unions and marketed by 28 state federations, ensuring that the benefits of every litre sold flow back to the communities that produce it.

This is more than just an economic system — it is a people-powered network that has transformed rural lives, providing a sustainable livelihood for millions and proving that grassroots ownership can deliver world-class results.

Along with this, Prime Minister Narendra Modi’s vision is to make Amul a global dairy giant that fits with the Atmanirbhar Bharat initiative, proving that grassroots enterprises can compete on the world stage without heavy subsidies. With the creation of the Ministry of Cooperation, India is scaling this success nationwide, targeting 200,000 new cooperatives. In 2025 — the International Year of Cooperatives — Amul’s presence in over 50 countries, including strategic entries into the USA and Europe, stands as proof that India’s farmer-led model is both globally competitive and deeply rooted in national values.

From a protest against unfair trade to a global brand in over 50 countries, Amul’s journey is a living example of how cooperation can drive national transformation. It has uplifted millions, made India the largest milk producer, and built a brand that earns trust in the world’s toughest markets. All while keeping farmers at its core.

Amul’s expansion into the USA and EU while resisting imports of foreign, hormone-treated dairy shows India can protect its farmers and still compete globally. In doing so, it offers a template for the Global South: self-sufficiency through cooperation, fair trade, and community-driven growth. In this International Year of Cooperatives, Amul does not just sell milk — it exports a proven model of rural empowerment and ethical enterprise, proving to the world that Bharat’s strength flows from the grassroots upward.

Source: Vayuveg

This is rooted in the cooperative model’s efficacy

iency and India’s unique rural enterprise. Uniting 3.6 million farmers and processing over 12 billion litres of milk annually, Amul’s projected ₹90,000 crore turnover underscores its vast scale and economic impact. Its 2025 entry into Europe — starting with Spain — coincides with the International Year of Cooperatives, highlighting India’s grassroots-powered global success. This achievement also reflects the national policy push towards Atmanirbhar Bharat, championed by Prime Minister Narendra Modi, who has emphasised empowering farmer-owned enterprises to build rural prosperity while competing confidently on international markets. Amul’s journey showcases how cooperative ownership, fair pricing, and strategic market growth combine to strengthen India’s dairy sector at home and abroad.

Amul, a success story rooted in rural town

The success of Amul began in 1946 when, in a small town in Anand, Gujarat, local dairy farmers were exploited by a trade cartel and sought the advice of Sardar Vallabhbhai Patel. Guided by Patel and with the leadership of Morarji Desai and Tribhuvandas Patel, they rejected middlemen, went on a milk strike and formed their own cooperative “the Kaira District Co-operative Milk Producers’ Union.”

Starting with just two village societies and 247 litres of milk, it has united 3.6 million farmers across 18,600 villages. As India’s largest FMCG brand standing alongside Amazon and Flipkart in value rankings, Amul carries not just products but a legacy — a people’s movement that turned farmer empowerment into a global business success.

The statistics mentioned below highlight that every increase in capacity or turnover translates into better milk procurement prices, improved rural infrastructure, and stronger local economies.

| Metric | Value (FY2023-2025) |

| Number of Farmer Members | 3.6 million |

| Number of Dairy Plants | 112 (planned to reach 113) |

| Milk Handling Capacity (Litres/Day) | 42 million |

| Annual Milk Processed (Billion Litres) | 12+ |

| Group Turnover (FY2023-24) | USD 10 billion (Rs 80,000 crore) |

| Group Turnover (FY2024-25) | USD 11 billion (Rs 90,000 crore) |

| IFCN World Ranking (Milk Processor) | 8th |

For farmers, ₹90,000 crore in projected turnover is proof that the cooperative model can deliver global-scale success without sacrificing grassroots ownership.

Amul's global footprint and market entry

Amul’s journey from a small cooperative in Anand to a presence in more than 50 countries is a testament to the power of farmer-led enterprise. The world's largest farmer-owned dairy cooperative processes about 12 billion litres of milk annually. With a brand turnover exceeding $11 billion, Amul ranks as the eighth-largest milk processor globally, operating 112 dairy plants across India and handling 42 million litres of milk per day.

Its products are now available in the USA, the UAE, Australia, Singapore, across Africa. Recently (June 2025), the cooperative officially commenced the launch of fresh milk products in Spain, beginning with distribution in key cities such as Madrid and Barcelona. This expansion is not just about selling milk abroad — it is about ensuring that the value generated from India’s dairy sector flows back to the people who make it possible. Every litre of milk sold internationally represents the work of Indian farmers and feeds directly into India’s rural economy, sustaining livelihoods and empowering communities.

The estimated annual export revenue of ~USD 180 million represents thousands of villages where farmers get higher returns, co-operatives can invest in chilling plants, and veterinary services can be expanded — all funded by income earned in foreign markets.

| Metric | Details |

| No of Countries Present In | 50+ |

| Key Regions/Countries | USA, UAE, Australia, Singapore, Africa, Europe (Spain, Portugal, Germany, Italy, Switzerland), Middle East |

| Mode of Entry (Fresh Milk) | Partnerships with local cooperatives (MMPA in US, COVAP in Spain) for milk collection/processing; GCMMF handles marketing/branding |

| Mode of Entry (Other Products) | Direct Exports (UHT milk, ghee, butter, paneer, mithai, infant food, cheese, curd, flavored milk, ice creams) |

| Estimated Annual Export Revenue (USD) | ~USD 180 million |

The entry into Europe in 2025, beginning with Spain and soon expanding to Portugal, Germany, Italy, and Switzerland, is especially significant. Europe’s dairy industry, despite receiving billions in subsidies through the Common Agricultural Policy, is facing farmer protests, falling herd sizes, and a generational crisis in farming. In contrast, Amul’s model thrives without massive subsidies, returning 70–80% of the consumer price directly to farmers. By partnering with European cooperatives such as Spain’s COVAP, Amul is not depleting Indian resources — it is exporting the cooperative spirit and brand value built in India, while the returns from these sales come home to strengthen the Indian economy.

This means the milk sold in Madrid or Lisbon is not diverting food from Indian consumers — it is the surplus capacity of a system that has made India the world’s largest milk producer. It turns Indian farmers into global suppliers while ensuring that the wealth generated abroad is reinvested in better prices for producers, rural infrastructure, and cooperative growth.

Moreover, when speaking about Amul going global, the current trade scenario marks a strategic reversal. While the US actively seeks to “dump surplus milk”, non-veg milk into India’s protected market, Amul is expanding exports of Indian milk and dairy products to developed economies including the USA and EU. This proves India’s dairy sector is both self-sufficient and globally competitive, countering US claims of inefficiency and strengthening India’s trade negotiating position.

In response, PM Modi has firmly stated that India will “never compromise” on the interests of farmers, fishermen, and dairy producers, even at a “heavy price.” This reflects a deliberate choice to defend farmer welfare and national values over short-term trade concessions.

From Anand to the world

The Amul Model, a three-tiered cooperative structure, links farmers directly to consumers, eliminating middlemen and ensuring fair returns. At the village level, dairy cooperative societies collect milk from producers. These societies are federated under district milk unions, which handle processing, and the unions are further federated under state-level marketing federations responsible for branding and distribution.

In this model, milk producers control procurement, processing, and marketing, while professional managers run operations with efficiency and scale. This structure has enabled India to become the largest milk producer in the world. Today, more than 16 million farmers supply milk to 185,903 village dairy cooperative societies. Their milk is processed in 222 district cooperative milk unions and marketed by 28 state federations, ensuring that the benefits of every litre sold flow back to the communities that produce it.

This is more than just an economic system — it is a people-powered network that has transformed rural lives, providing a sustainable livelihood for millions and proving that grassroots ownership can deliver world-class results.

Along with this, Prime Minister Narendra Modi’s vision is to make Amul a global dairy giant that fits with the Atmanirbhar Bharat initiative, proving that grassroots enterprises can compete on the world stage without heavy subsidies. With the creation of the Ministry of Cooperation, India is scaling this success nationwide, targeting 200,000 new cooperatives. In 2025 — the International Year of Cooperatives — Amul’s presence in over 50 countries, including strategic entries into the USA and Europe, stands as proof that India’s farmer-led model is both globally competitive and deeply rooted in national values.

From a protest against unfair trade to a global brand in over 50 countries, Amul’s journey is a living example of how cooperation can drive national transformation. It has uplifted millions, made India the largest milk producer, and built a brand that earns trust in the world’s toughest markets. All while keeping farmers at its core.

Amul’s expansion into the USA and EU while resisting imports of foreign, hormone-treated dairy shows India can protect its farmers and still compete globally. In doing so, it offers a template for the Global South: self-sufficiency through cooperation, fair trade, and community-driven growth. In this International Year of Cooperatives, Amul does not just sell milk — it exports a proven model of rural empowerment and ethical enterprise, proving to the world that Bharat’s strength flows from the grassroots upward.

Source: Vayuveg

.

.

.

.