FinMin announces Rs 3 lakh crore collateral free loan for MSMEs; Brings up new definition of MSMEs

Total Views | 34

New Delhi, May 13: A day after Prime Minister Narendra Modi announced the 'Aatma Nirbhar package' of Rs 20 lakh crore, Finance Minister Nirmala Sitharaman said that the package aims to spur growth and build a very self reliant India. She said would announce 15 measures- 6 today for MSMEs, PF, HFCs and MFIs, discoms, contractors, real estate and three tax measures.

As the nation waited for the details of the Rs 20 lakh crore economic package, Finance Minister revisited some of the previous schemes brought in by the central government. From PM Garib Kalyan Scheme to IBC and GST reforms. "The Direct Benefit Transfer, Microinsurance schemes, PM Awas Yojana, PM Ujjwala Yojana, Swachh Bharat and Ayushman Bharat were all transformative reforms which have benefited the poor in a big way," she said adding that Rs 18,000 crore of refunds to I-T taxpayers, drawbacks are also given and 14 lakh taxpayers have been benefited.

Finance Minister said that starting today, she will hold daily pressers along with her teams to detail a number of responses the government has prepared to bring the economy back on track. "We will come with tranches beginning today. We have responsibility towards poor, needy, migrant and divyang (differently-abled)," Sitharaman said. Here are the 6 significant measures she announced today for MSMEs-

1. Rs 3 lakh crore collateral free loan for MSMEs- Businesses and MSMEs have badly been hit due to Covid-19 and they need additioanl funding to meet operational liabilites built up, buy raw material and restart business.

- Rs 3 lakh crore collateral free loan, for those with Rs 25 crore outstanding loan or Rs 100 crore turnover.

- Loans with 4-year tenure, moratorium of 12 months.

- 100% credit guarantee to banks and NBFCs on principal and interest.

- To benefit 45 lakh units.

- Scheme can be availed till 31 October 2020

- No guarantee fee, no fresh collateral

Finance Minister Smt.@nsitharaman to address a press conference today, 13th May, at 4PM in New Delhi.

— Ministry of Finance (@FinMinIndia) May 13, 2020

Watch LIVE here- 👇

➡️ YouTube - https://t.co/bgKzb6XZTE

Follow for LIVE updates -

➡️ Twitter - https://t.co/XaIRg2XMdH

➡️ Facebook - https://t.co/fbhkc9N4tk pic.twitter.com/6UZWZoiG0m

2. Rs 20000 cr as subordinate debt-

- Two lakh MSMEs are likely to benefit

- Functioning MSMEs which are NPA or are stressed will be eligible

- Gov will provide a support of Rs 4000 cr to CGTMSE

- CGTSME will provide partial credit Guarantee support to banks

- Promoter of the MSMEs will be given debt by banks, which will then be infused by promoters as equity in the unit

3. Rs 50,000 cr equity infusion for MSMEs through fund of funds- MSMEs face severe shortage of equity. The government will infuse Rs 50,000 crore for MSMEs, which are viable businesses but need hand holding due to Covid-19

- Fund of funds with corpus of Rs 10,000 cr will be set up

- Will provide equity funding for MSMEs, with growth potential and visibility

- FOF will be oprated through a mother fund and few daughter funds

- Fund structure will help leverage Rs 50,000 cr of funds at daughter funds level

- Will help expand MSMEs size as well as capacity

- Will encourage MSMEs to get listed on main board of Stock Exchanges

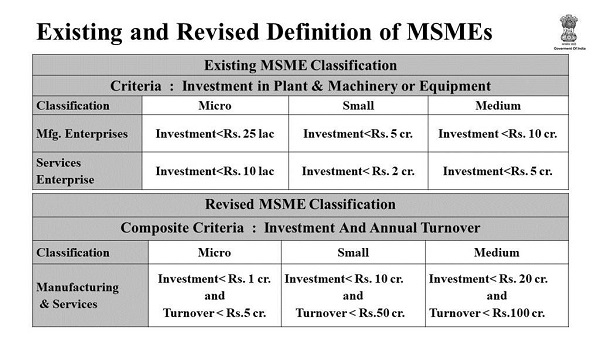

4. New definition of MSMEs- Low threshold in MSME definition have created fear among MSMEs of graduating out of the benefits and hence killing the urge to grow. The Manufacturing and services are now one classification.

Micro: Investments less than Rs 1 cr and turnover of less than Rs 5 cr

Small: Investment less than Rs 10 cr and turnover less than Rs 50 cr

Medium: Investment less than Rs 20 cr and turnover less than Rs 100 cr

5. Global tenders to be disallowed upto Rs 200 cr- For government procurement, tenders upto Rs 200 crore will no longer be under global tender route. Big benefit to MSMEs, which used to get disqualified, and disallowed from participation. Indian MSMEs and other companies have often faced unfair competition from foreign companies. Necessary amendments to be brought about in General Financial Rules

6. All receivables of MSMEs will be cleared by govt and PSUs in 45 days- E-Market linkage for SMES since trade fairs and exhibitions may not be held post-Covid. All receivables of MSMEs will be cleared by GoI and PSUs within next 45 days.

On Tuesday evening, PM Modi pitched for a self-reliant India in the post Covid-19 world as he announced an economic package that is about 10 per cent of the country’s GDP. The Prime Minister said the package would help every section of society, including workers, farmers, the middle class, industrial units and the MSME sector.

The stimulus will play an important role in the ‘Atmanirbhar Bharat Abhiyan’ (Self-reliant India Campaign), PM Modi had said. “India’s self-reliance will be based on five pillars — economy, infrastructure, technology driven system, vibrant demography and demand. When India speaks of self-reliance, it does not advocate for a self-centered system. In India’s self-reliance there is a concern for the whole world’s happiness, cooperation and peace,” he said.