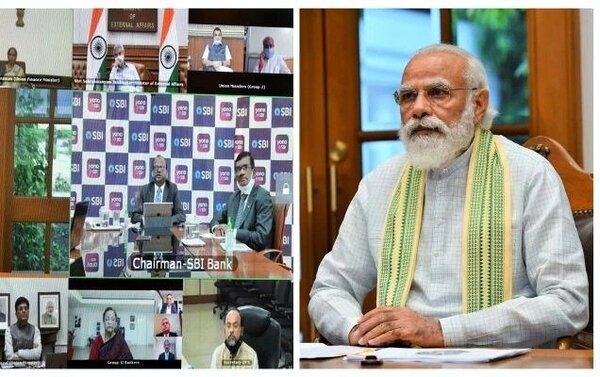

PM Modi discuss economic measures with stakeholders from Banks and NBFCs

Total Views | 53

New Delhi, July 30: In order to discuss the vision and roadmap for the future, Prime Minister Narendra Modi chaired a virtual meeting with stakeholders from Banks and Non-bank financial institutions (NBFCs). He assured that the central government is ready to take any steps necessary to support it and promote the growth of the banking system.

PM Modi discussed the crucial role of the financial and banking system of supporting growth. It was emphasized on the importance of credit and its growth. "It was noted that the small entrepreneurs, SHGs, farmers should be motivated to use institutional credit to meet their credit needs and grow. Each bank needs to introspect and take a relook at its practices to ensure stable credit growth," the statement read.

Had an extensive interaction with stakeholders from banks and NBFCs to deliberate on the roadmap for economic growth, helping entrepreneurs and a range of other aspects. https://t.co/0yX7gWfG07

— Narendra Modi (@narendramodi) July 29, 2020

Further, it was asserted that banks should not treat all proposals with the same yardstick and need to distinguish and identify bankable proposals and to ensure that they get access to funding on their merit and don’t suffer in the name of the past NPAs. PM Modi, later on, assured them that the government is firmly behind the banking system. The government is ready to take any steps necessary to support it and promote its growth.

With an aim to ramp up economic growth, measures were discussed. "Banks should adopt fintech like centralized data platforms, digital documentation, and collaborative use of information to move towards digital acquisition of customers. This will help increase credit penetration, increase ease for customers, lower costs for banks, and also reduce frauds," it added.

To boost the digitalization among the Indians and calling for 'Atmanirbhar Bharat', they gave suggestions. "India has built a robust, low-cost infrastructure that enables every Indian to undertake digital transactions of any size with great ease. Banks and Financial Institutions should actively promote the use of RUPAY and UPI amongst its customers," it stated.

The progress of schemes like emergency credit line for MSME, additional KCC cards, liquidity window for NBFC, and MFI was also reviewed. While it was noted that significant progress has been made in most schemes, banks need to be proactive and actively engage with the intended beneficiaries to ensure that the credit support reaches them in a timely manner during this period of crisis.

Bharati Web